Sometimes, a difficult financial situation may force you to sell gold or silver as a means to generate quick cash. It could be embarrassing if all your neighbors were gossiping about your misfortune. In another scenario, a nosy person who hears about your recent acquisition of precious metals may share the information with the wrong person – possibly even a criminal.

Selling gold and silver can be both a valuable and rewarding process. However, for many individuals, handling such transactions discreetly is of utmost importance. It’s not just about finding the right dealer or ensuring fair pricing; it’s also about protecting your privacy, maintaining security, and safeguarding your legal interests.

This blog will explore why discretion plays such a critical role in selling precious metals. From avoiding unnecessary attention to ensuring compliance with legal requirements, we’ll cover the key reasons to prioritize privacy and how California Gold & Silver Exchange can be a trusted partner in this process.

Nosy Neighbors and Traveling for Privacy

When it comes to gold and silver transactions, everyone values their privacy differently. While some feel comfortable conducting precious metal sales in their local area, others prefer to avoid potential encounters with acquaintances, colleagues, or even friends. Why? Because these transactions can draw unnecessary attention from curious neighbors or individuals who may misuse the information about your assets.

If you value privacy above all else, it may be worth considering an extra step of traveling to another town to complete your sale. Not only does this reduce the likelihood of being recognized, but it also helps protect you from unsolicited advice or judgment about your financial decisions. After all, keeping your financial matters private is a choice worth making.

Tip: Always verify the reputation of the dealer you plan to visit, especially if you’re venturing out of your local area.

RELATED: Making the Most of Your Road Trip To See Us

Privacy Concerns for Sellers

Financial matters are deeply personal, and selling gold and silver is no exception. Being upfront about such transactions in public or with unchecked third parties can lead to several potential risks, including exposure to those who shouldn’t have information about your assets or dealings.

Discretion ensures that your business remains your own, providing peace of mind knowing that your personal financial decisions are confidential. Whether you’re working with a dealer online or in person, it’s essential to inquire how your data will be stored and who will have access to it.

Key Benefit:

- Your financial dealings remain private, shielding you from unwanted attention or misuse of sensitive information.

Security and Theft Prevention

Public knowledge of a transaction involving gold or silver can lead to significant security risks. When others become aware of your dealings, you may inadvertently make yourself a target for theft or burglary.

A reputable and discreet precious metals dealer operates with your security in mind. From private meeting rooms to secure communication practices, safeguarding your transaction details ensures that only you and the necessary parties are involved.

How Discretion Helps:

- Minimizes risk by reducing public awareness of your sale.

- Keeps your assets protected, even post-transaction.

For optimal security, always choose dealers with clear privacy protocols to ensure a smooth and safe experience.

Identity Protection

Selling gold and silver typically involves sharing personal identification information to comply with regulations. However, over-sharing can expose sellers to risks like identity theft or fraud if the process isn’t handled securely.

Working with a trusted dealer that values discretion ensures that you only share the necessary information. A professional will request just what is needed for legal compliance while protecting you from harvesting or misuse of that data.

Pro Tip:

- Always ask your dealer about their data security practices and how your documents are stored or disposed of after the transaction.

Legal and Tax Considerations

Many sellers wonder if selling gold anonymously is both possible and smart. While discretion is vital, anonymity should never replace transparency with legal and tax obligations. Financial laws, such as IRS reporting thresholds and anti-money laundering (AML) rules, require precise reporting for transactions over specific limits.

A trustworthy dealer ensures proper compliance while keeping your information confidential. Their in-depth understanding of local and federal regulations allows them to guide you through the process without exposing you to unnecessary risk.

Why Proper Reporting Matters:

- Avoid legal disputes or financial penalties down the line.

- Gain confidence in knowing you’re fully compliant with all regulations.

Remember, an ethical approach to selling precious metals doesn’t compromise on discretion.

Trust and Comfort in Transactions

Selling gold and silver can feel daunting, especially for first-time sellers. Establishing a relationship with a reputed dealer who values your privacy builds trust and offers comfort throughout the transaction process.

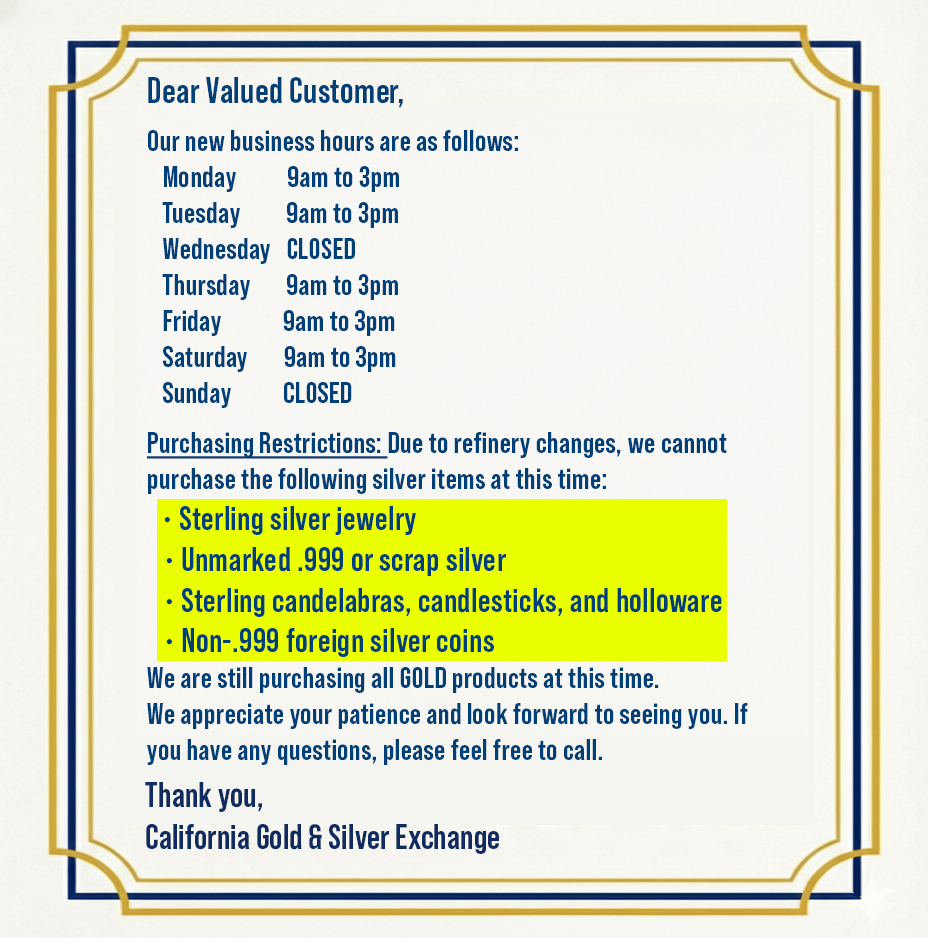

From confidential consultations to secure handling of your valuables, a professional approach bolsters confidence in the service while ensuring that every detail is managed discreetly. At California Gold & Silver Exchange, this is the foundation of our customer experience.

What to Look For in a Dealer:

- A strong track record of client trust and positive reviews.

- Clear policies that prioritize confidentiality in every interaction.

Collaborating with a dealer who values discretion eliminates the stress and uncertainty often associated with such transactions.

Safeguarding Against Risks with Discreet Gold Transactions

Maintaining privacy in precious metals sales protects not only your personal information but also your physical safety. Discretion discourages criminal activity while ensuring compliance with legislation tailored for such transactions.

Still, it’s crucial to understand that anonymous transactions without proper documentation may expose sellers to legal complications. Partnering with a reputable dealer eliminates these challenges, offering a solution rooted in both trust and professionalism.

Why Choose Discreet Transactions:

- Enhanced personal security.

- Peace of mind knowing you’re legally protected.

- Partnerships with ethical buyers who respect your privacy.

At California Gold & Silver Exchange, we specialize in balancing discretion with transparency, helping every client sell their assets confidently and securely.

Take the Next Step with California Gold and Silver Exchange

Selling gold and silver doesn’t have to be a risky or stressful experience. By prioritizing discretion, you’re taking necessary steps to protect your privacy, meet legal requirements, and ensure your security, all while maintaining control over your financial dealings.

At California Gold & Silver Exchange, we pride ourselves on offering a professional, trustworthy, and confidential experience for every client. Whether you’re selling a small piece of antique jewelry or liquidating a portion of your investment, our experts are here to support you through every step of the process.

Visit us today or reach out to learn how we can help you sell your precious metals with confidence.