How to Know if Yelp Reviews Are Real: Hidden Filters, Fake Reviews & What They Really Mean

When you’re looking to sell gold, silver, or other precious metals, online reviews can make or break your decision about which dealer to trust. With thousands of dollars potentially at stake, you want to work with a reputable business that treats customers fairly and offers competitive prices.

But here’s the problem: not all Yelp reviews are what they seem. In fact, many businesses manipulate their online reputation through fake reviews, paid testimonials, and other deceptive practices that can mislead potential customers.

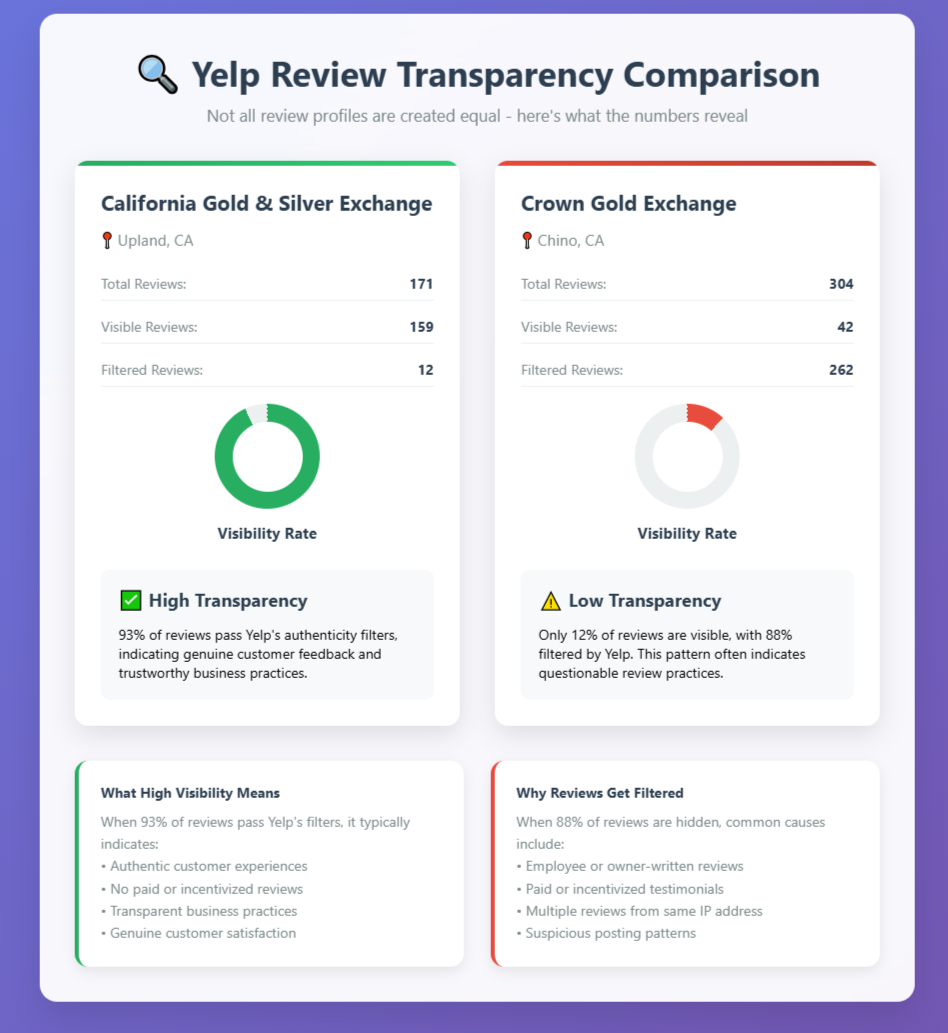

Consider this eye-opening comparison: California Gold & Silver Exchange in Upland shows 93% of their total reviews publicly, while Crown Gold Exchange in Chino shows only 12% of their reviews. What happened to the other 88% of Crown Gold’s reviews? They’ve been filtered by Yelp’s algorithm—and there’s usually a good reason why.

Yelp’s Filter System: What Most People Don’t Know

Yelp uses a sophisticated algorithm to filter out reviews it considers suspicious, fake, or unreliable. This filtering system is designed to protect consumers from misleading information, but most people don’t even know it exists.

Here’s what you need to understand about Yelp’s filtering:

Filtered reviews don’t count toward the overall star rating. A business might have 300 total reviews, but if 200 are filtered, only 100 count toward their displayed rating.

Filtered reviews are still visible—if you know where to look. At the bottom of every Yelp business page, there’s a small link that says “filtered reviews” or “reviews that are not currently recommended.” Click this link to see what Yelp has hidden.

The filtering happens automatically. Yelp’s algorithm looks for patterns that suggest fake or manipulated reviews, including:

- Multiple reviews from the same IP address

- Reviews from accounts with suspicious activity

- Content that appears to be written by business owners or employees

- Reviews that follow unnatural patterns or timing

Most consumers never scroll down to find this filtered content, which means they’re making decisions based on incomplete information.

A Real Example: Transparency in Action

Let’s examine two local precious metals dealers to see how Yelp filtering reveals important differences in business practices:

California Gold & Silver Exchange (Upland):

- Visibility rate: 93%

- Total reviews: 171

- Visible reviews: 159

- Filtered reviews: 12

A Competitor (Chino):

- Total reviews: 304

- Visible reviews: 42

- Filtered reviews: 262

- Visibility rate: 12%

This stark difference raises important questions. Why would Yelp filter 86% of one business’s reviews while allowing 93% of another’s to remain visible?

The answer typically lies in review quality and authenticity. When a business has an unusually high percentage of filtered reviews, it often indicates:

- Incentivized or paid reviews

- Reviews written by employees or business owners

- Coordinated review campaigns

- Other manipulative practices

Businesses with transparent review profiles, like California Gold & Silver Exchange, tend to have much higher visibility rates because their reviews come from genuine customers sharing authentic experiences.

How to Spot Fake Yelp Reviews

Even among visible reviews, some may still be questionable. Here are red flags to watch for:

Content Warning Signs:

- Extremely short, generic comments like “Great service!” or “Highly recommend!”

- Overuse of business names or keywords (clear SEO manipulation)

- Overly emotional language without specific details

- Perfect grammar in reviews from accounts that otherwise show poor writing skills

Reviewer Profile Red Flags:

- No profile photo or obvious stock photos

- Account created recently with only one review

- History of only 5-star reviews across different industries

- Multiple reviews posted on the same day across different businesses

Timing Patterns:

- Sudden bursts of positive reviews around business launches or promotions

- Multiple reviews posted within hours of each other

- Reviews that respond to specific negative feedback (damage control)

Geographic Inconsistencies:

- Reviews from users in distant locations for local businesses

- Multiple reviews from users in the same small geographic area for a regional business

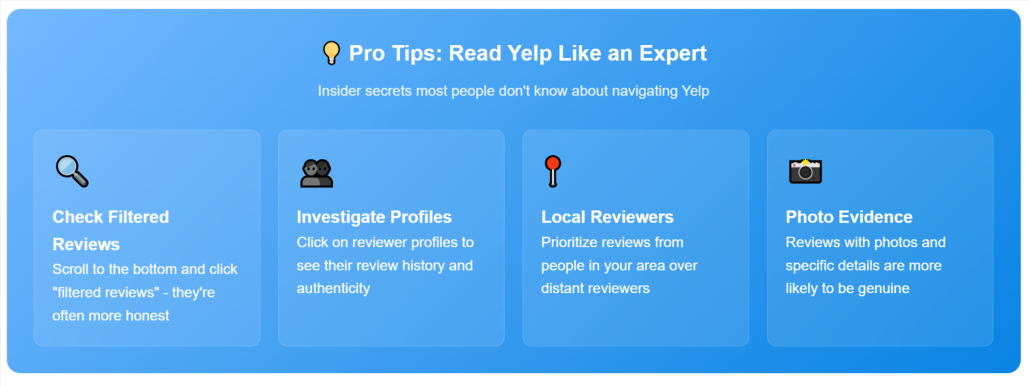

Yelp Secrets: How to Read Reviews Like a Pro

Most people simply look at star ratings and read a few recent reviews. But there are insider techniques that reveal much more about a business’s true reputation:

Most people simply look at star ratings and read a few recent reviews. But there are insider techniques that reveal much more about a business’s true reputation:

1. Always Check Filtered Reviews Scroll to the bottom of any Yelp page and click on filtered reviews. These often contain the most honest feedback because they haven’t been curated or manipulated.

2. Examine Reviewer Profiles Click on reviewer names to see their history. Real customers typically have:

- Multiple reviews across different businesses

- Photos and detailed profiles

- Consistent writing style and local geographic focus

- A mix of ratings (not just 5-stars)

3. Look for Photo Evidence Reviews with photos are much more likely to be authentic. Real customers often share pictures of their experience, products, or the business location.

4. Read the Middle-Range Reviews 3-star and 4-star reviews often provide the most balanced, honest feedback. They’re less likely to be fake because most businesses don’t pay for mediocre reviews.

5. Check Response Patterns Notice how businesses respond to negative reviews. Professional, helpful responses suggest good customer service, while defensive or aggressive responses are red flags.

6. Analyze Review Dates Look for natural patterns in review timing. Authentic businesses receive reviews steadily over time, while suspicious businesses often show clusters of reviews around specific dates.

Why Transparent Review Profiles Matter

When choosing a precious metals dealer, review transparency matters for several reasons:

Authentic Feedback: Businesses with high visibility rates are more likely to show genuine customer experiences, both positive and negative.

Trustworthy Practices: Companies that don’t manipulate reviews typically don’t manipulate other aspects of their business either.

Real Problem Resolution: You can see how businesses handle complaints and whether they actually resolve customer issues.

Accurate Expectations: Unfiltered reviews give you a realistic picture of what to expect from your experience.

California Gold & Silver Exchange’s 93% review visibility rate demonstrates this transparency in action. Customers can read authentic feedback from real transactions and make informed decisions based on genuine experiences.

Beyond Yelp: Diversifying Your Research

While Yelp can be valuable when used correctly, smart consumers don’t rely on a single review platform:

- Google Reviews: Often less filtered than Yelp, though still subject to manipulation

- Better Business Bureau: Provides complaint resolution history and accreditation status

- Industry-Specific Sites: Precious metals forums and communities often share dealer experiences

- Word of Mouth: Personal recommendations from friends and family remain highly valuable

Red Flags in Precious Metals Reviews

When evaluating gold and silver dealers specifically, watch for these warning signs in reviews:

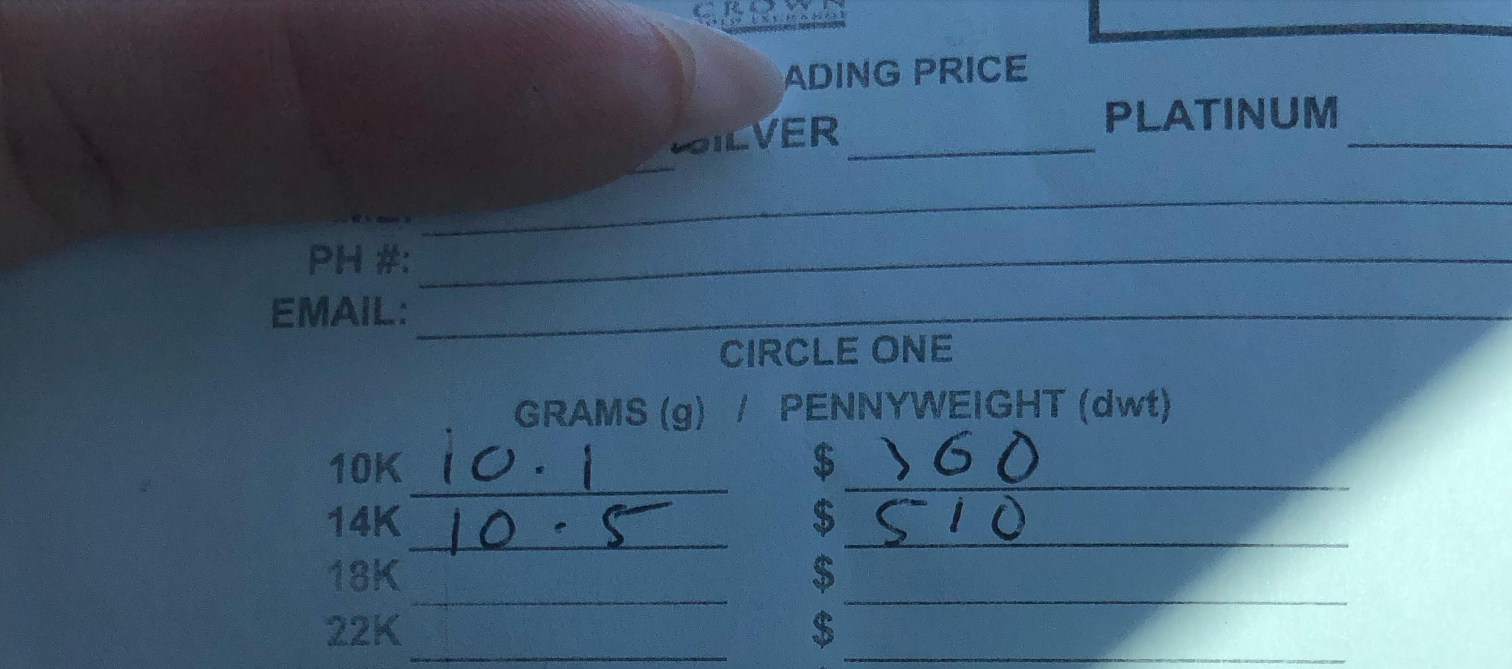

Pricing Concerns:

- Complaints about low buyback prices with no explanation

- Reviews mentioning hidden fees or changed quotes

- Stories about pressure tactics or rushed transactions

Professionalism Issues:

- Multiple mentions of unprofessional staff behavior

- Complaints about cleanliness or security of the facility

- Reviews describing disorganized or chaotic operations

Business Practice Problems:

- Stories about changed terms after agreements

- Complaints about difficulty getting items back

- Reviews mentioning questionable business licensing or credentials

Making Smart Decisions

The goal isn’t to find perfect reviews—every business will have some negative feedback. Instead, look for:

- Consistent Patterns: Do most customers report similar positive experiences?

- Professional Responses: How does the business handle complaints publicly?

- Specific Details: Do reviewers mention specific staff members, processes, or outcomes?

- Recent Activity: Are there current reviews showing the business is actively serving customers?

Conclusion: Trust What You Can Verify

Yelp reviews can be a valuable tool for choosing a precious metals dealer, but only when you understand how to read them properly. By checking filtered reviews, examining reviewer profiles, and looking for authentic patterns, you can cut through the noise and find businesses that truly serve their customers well.

The difference between a 93% review visibility rate and a 12% rate isn’t just a statistic—it’s a reflection of business practices and customer satisfaction. When you’re dealing with valuable assets like gold and silver, this transparency matters.

Before making your next precious metals transaction, take the time to properly research your options. Check the filtered reviews, examine the patterns, and choose a dealer whose online reputation reflects genuine customer satisfaction rather than manufactured marketing.

Your gold and silver deserve a dealer you can trust—and now you know how to find one.

Ready to experience transparent, honest precious metals dealing? Visit California Gold & Silver Exchange in Upland and see why 93% of our customer reviews pass Yelp’s authenticity filters. Our reputation speaks for itself because our customers speak for us.