We have received your message. If you indicated that you would like to make an appointment, we will reach out to you shortly.

When you sell gold to us, we will explain every step of the process to help you understand how selling gold works. With your XRF Precious metals Analyzer, we can test your gold to know exactly what purity your gold contains. This helps us assess your gold to give you the most when you sell.

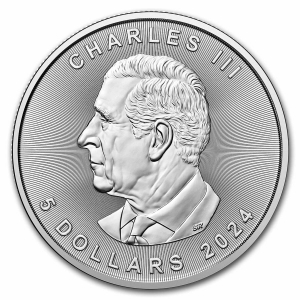

The new 2024 Silver Maple Leafs are highly collectible and historically significant because for the first time ever the front face has a monarch other than Queen Elizabeth II gracing it.

Canada’s signature silver bullion coin is one of the world’s most iconic and instantly recognizable coins. Since its introduction in 1988, the coin has featured a maple leaf on the reverse and Queen Elizabeth II on the face.

Instead of Queen Elizabeth II (who passed away in on Sept. 8, 2022), this year’s coin introduces the first Canadian effigy of King Charles III. His Majesty King Charles III was officially proclaimed King of Canada on Sept. 10, 2022.

Why a Maple Leaf?

The maple leaf has been Canada’s national symbol since the 1800s. Canadian pennies started featuring maple leaves in the 1850s. Then from 1876 to 1901, the maple leaf appeared on all Canadian coins.

Of course, the maple leaf isn’t just used on coins. It’s also a symbol of Canadian identity. In 1868, it was used on the Ontario and Quebec coat of arms. It was on the Olympic uniforms of Canadian athletes beginning in 1908. It was featured on Canadian military uniforms and equipment in both World Wars. And it was put on the country’s new national flag in 1965.

It’s said that the distinctive maple leaf signifies pride, connection, and community.

Highlights of the 2024 Silver Maple Leafs

Here are some coin highlights:

- Each one-ounce 2024 Silver Maple Leaf is $5 Canada legal tender.

- The Silver Maple Leafs are minted at the Royal Canadian Mint.

- The coins are highly pure 99.99% fine silver.

- The smaller leaf below and slightly to the right of the centerpiece maple leaf is micro-engraved with the number 24 and serves as advanced anti-forgery protection against counterfeiters.

Get Your 2024 Silver Maple Leafs Today

Silver Maple Leafs are always in high demand with collectors, but with the historical significance of the 2024 Silver Maple Leafs, demand is expected to be heavy. So, get yours today!

Call (909) 985-4653 or click here to contact us for current prices.

When the economy is uncertain and markets fluctuate, many investors turn to precious metals as a more reliable option, but knowing how to get started with investing in precious metals is a critical first step.

Investing in precious metals like gold and silver offers a hedge against inflation, currency devaluation, and geopolitical instability. But there are specific strategies involved for investing in gold and silver, as well as important considerations for newcomers to the market.

Overview of Investing in Precious Metals

Investing in precious metals involves purchasing physical assets such as gold, silver, platinum, and palladium. These metals have been valued throughout history for their rarity, durability, and intrinsic worth.

Unlike stocks or bonds, which can be influenced by economic conditions and company performance, the value of precious metals is largely independent of these factors.

Benefits of Investing in Precious Metals

There’s a reason that so many people continue to invest in precious metals. Actually, there are several reasons. Here are some of the benefits of doing so:

- Diversification: Precious metals provide diversification within an investment portfolio, reducing overall risk.

- Inflation Hedge: Historically, precious metals have retained their value during times of inflation, making them a reliable hedge against currency devaluation.

- Store of Value: Gold and silver have been recognized as stores of value for thousands of years, offering stability in uncertain economic environments.

- Liquidity: Precious metals are easily bought and sold, providing investors with liquidity when needed.

Investing in Gold

Gold is the most popular precious metal for investors. Its popularity is due to its scarcity and enduring value. Plus, you can buy gold in various forms, including coins and bars.

Gold coins, such as American Eagles or Canadian Maple Leafs, are minted by government agencies and are highly recognizable and easy to trade.

Gold bars, typically available in various weights ranging from grams to kilograms, offer investors a cost-effective way to acquire larger quantities of gold.

Investing in Silver

Silver is another attractive option for investors seeking exposure to precious metals. Like gold, silver can be purchased in the form of coins or bars.

Silver coins that are popular investments include the American Silver Eagle and the Austrian Philharmonic, known for their purity and quality.

Silver bars are available in various sizes and are an affordable option for investors looking to diversify their portfolios.

Things to Consider When Investing in Precious Metals

Before you get started with investing in precious metals, here are some things to consider:

- Storage and Security. Consider how you will store your precious metals to ensure their safety and security.

- Market Conditions. Keep an eye on market trends and factors influencing the price of precious metals, such as interest rates and geopolitical events.

- Dealer Reputation. Choose a reputable dealer with a track record of reliability and transparency.

- Factor in transaction costs, premiums, and potential taxes when purchasing precious metals.

Start Investing in Precious Metals Today!

Investing in precious metals offers stability and diversification in an ever-changing financial landscape. Plus, buying gold and silver provides valuable opportunities to safeguard your wealth and preserve purchasing power for the future.

Contact the experts at California Gold & Silver Exchange to learn more about how you can start building your investment portfolio with gold and silver. With their guidance and expertise, you can navigate the complexities of the precious metals market and make informed investment decisions.

Call (909) 985-4653 or click here for more ways to contact us.

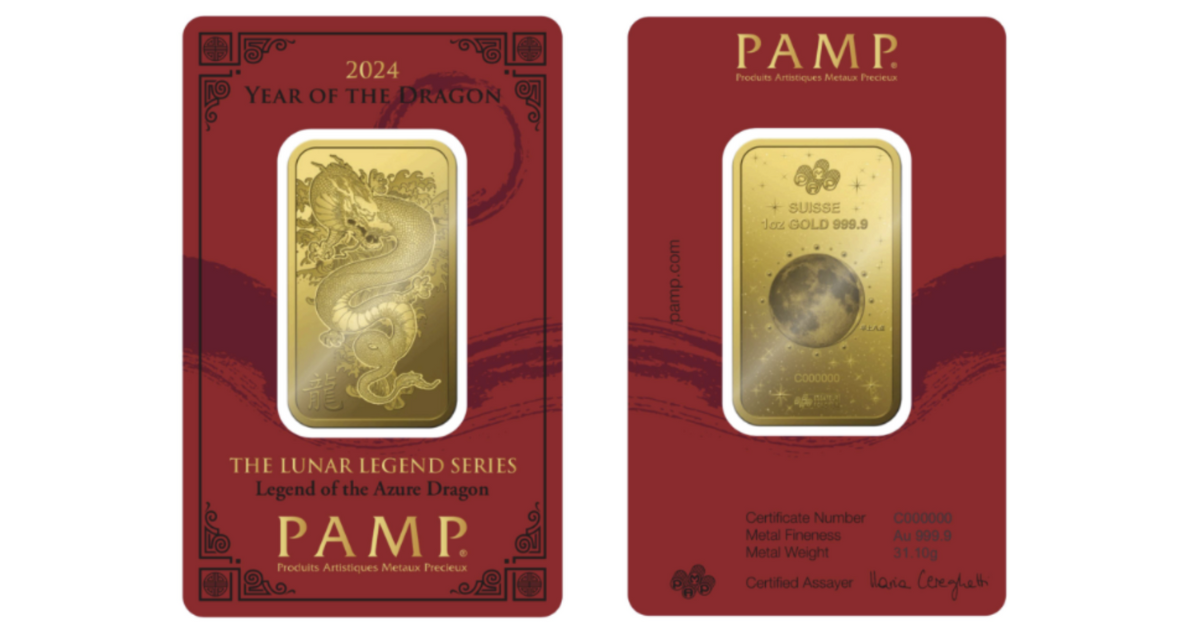

The acts of collecting and investing in gold merge into one with the new series of PAMP Lunar New Year Gold Bars.

This is a beautiful series of minted bullion bars — 5g and 1oz options are available. Each gold bar carries a unique serial number and features a stunning proof-like finish.

And the brilliant red CertiPAMP™ assay card and accompanying envelope makes each annual ingot the ideal New Year gift and collectible.

2024: The Year of the Dragon

The series will celebrate each Lunar New Year, beginning with the 2024 Year of the Dragon. This Year of the Dragon begins on Feb. 10, 2024 and ends on Jan. 28, 2025, when the Year of the Snake will begin.

The PAMP Lunar New Year gold bars tell legendary stories related to each of the 12 animals of the Chinese Zodiac. As this is the Year of the Dragon, the first bar tells the Legend of the Azure Dragon.

The Azure Dragon

The Azure Dragon is one of the most celebrated dragons in China and one of the four symbols of the Chinese Constellation.

According to mythology, the Azure Dragon is believed to bring good luck and prosperity. While the Azure Dragon is said to control the elements of water and air, it’s also associated with the element of wood, representing growth, renewal, and vitality.

Further, as Guardian of the East, the Azure Dragon is a harbinger of the coming spring season, bringing rain that is essential for bountiful harvests.

The Hour of the Dragon

The obverse design on the bar depicts each of the twelve animals of the lunar cycle as a large star encircling the new moon. The dragon is fifth clockwise, in the 4:00 position.

Throughout the day, each animal has a two-hour window of potency. The dragon is at its most powerful between the hours of 7 and 9 a.m. Its zenith is at 8 a.m.

Get Your 2024 Year of the Dragon PAMP Lunar New Year Gold Bars Today

The 5g gold bar is .90mm thick and measures 13.1mm x 22.1mm.

The 1oz gold bar is 1.71mm thick and measures 24mm x 41mm.

They are an exquisite collectible investment and only available while supplies last. Get yours today!

Call (909) 985-4653 or click here to contact us for current prices.