There’s a process to selling jewelry to get needed cash, and when you know the secrets of how to get the most money when selling silver jewelry, you’ll find that process easier to navigate.

You really can make money by selling your silver jewelry, whether it’s from outdated pieces, inherited items, or simply jewelry you no longer wear. However, to ensure you’re getting the most money for your silver, it’s important to approach the process strategically.

By taking the time to understand the value of your jewelry, researching potential buyers, and avoiding common pitfalls, you can maximize your payout. Here are some expert tips on how to get the most money when selling your silver jewelry:

1. Understand the Value of Your Silver Jewelry

Before you sell your silver jewelry, it’s essential to know its worth. Several factors influence the value of silver pieces, including the following:

- Purity. Silver jewelry is often made from sterling silver, which contains 92.5% pure silver. Look for a stamp or hallmark that indicates its purity — usually marked as “925” or “sterling.” Jewelry with higher silver content will naturally be worth more.

- Weight. Like gold, silver is priced by weight, typically measured in grams or troy ounces. The heavier the piece, the more valuable it is. You can get a rough idea of your jewelry’s weight using a kitchen scale, or you can have it professionally weighed.

- Condition. While silver is typically valued by its metal content, the condition of your jewelry can also play a role. Pieces that are in excellent condition or come from well-known designers may fetch a higher price than plain or damaged items.

- Current Market Price. Silver prices fluctuate daily based on market demand, geopolitical events, and economic factors. Check the current spot price of silver before you sell to ensure you’re making your transaction when prices are high.

2. Get Multiple Offers

Just like when selling gold jewelry, it’s important to get multiple offers when selling silver jewelry. Here’s how:

- Visit Several Buyers. Contact different types of buyers, including local jewelers, pawn shops, or specialized silver buyers like California Gold & Silver Exchange. You can also explore online options, but be sure you choose reputable companies with positive reviews.

- Ask for Appraisals. Many buyers will offer free appraisals, where they assess the purity, weight, and value of your silver jewelry. It’s worth getting appraisals from multiple buyers so you can compare offers.

- Compare Offers Carefully. Different buyers may offer different prices for your silver. Don’t settle for the first offer you receive. By comparing multiple offers, you can choose the one that gives you the best payout.

3. Choose a Reputable Buyer

Choosing the right buyer is key to getting the most money for your silver jewelry. Here’s what to look for in a reputable buyer:

- Established Businesses. Opt for buyers who have been in business for a long time. These companies often have a track record of fair and transparent dealings. California Gold & Silver Exchange, for example, has deep family roots in the industry and is known for offering some of the highest payouts in Southern California.

- Credentials. Look for buyers who are members of professional organizations, such as the Better Business Bureau (BBB) or the American Numismatic Association (ANA). These affiliations indicate a commitment to ethical business practices.

- Customer Reviews. Check customer reviews and testimonials to see how others have been treated. A reputable buyer should have consistent positive feedback, especially regarding fair pricing and customer service.

4. Timing Is Everything

To get the most money when selling your silver jewelry, timing can make a big difference. Here are some factors to consider:

- Watch the Market. Silver prices, like gold, fluctuate over time. Keep an eye on the market and try to sell when prices are high. You can monitor silver prices online or ask your buyer for insights into market trends.

- Consider Economic Conditions. Silver tends to be in higher demand during periods of economic uncertainty, as it’s often seen as a safe haven investment. If you’re not in a hurry to sell, you might consider holding onto your silver until there’s an increase in demand.

5. Avoid Common Pitfalls

Selling silver jewelry isn’t without its risks, so it’s essential to avoid common pitfalls that could reduce your payout. Here are some things to beware of:

- Lowball Offers. Some buyers may offer significantly less than your silver is worth, hoping you’ll take the first offer you get. This is why it’s so important to shop around and compare offers.

- Hidden Fees. Some buyers may try to tack on hidden fees, such as appraisal costs or processing charges. A reputable buyer will be upfront about any fees and should not surprise you with extra costs after making an offer.

- Scams and Disreputable Buyers. Be cautious of buyers who use high-pressure tactics or who are unwilling to explain their evaluation process. Stick with trusted buyers who prioritize transparency and customer service.

6. Consider the Design and Brand

In some cases, the design or brand of your silver jewelry can add to its value. Here’s how to take advantage of this:

- Designer Pieces. If your silver jewelry is from a well-known designer or brand, it may hold more value than just the weight of the silver. Some buyers specialize in designer jewelry and may offer a premium for such pieces.

- Antique or Vintage Jewelry. Silver jewelry with historical or vintage appeal can also be worth more to certain buyers. Consider getting a separate appraisal from an antique or vintage jewelry expert if you suspect your pieces may have added value.

Get Top Dollar When Selling Your Silver Jewelry

Selling silver jewelry can be a rewarding process, especially when you take the time to ensure you’re getting the best possible price. By following these expert tips and strategies, you can walk away from your sale feeling confident you got the most for your jewelry.

At California Gold & Silver Exchange, we’re committed to helping you get top dollar for your silver jewelry. We offer free, no-obligation appraisals and pride ourselves on providing transparent, honest evaluations with some of the highest payouts in Southern California.

Visit us today to get started, and let us help you turn your silver jewelry into cash!

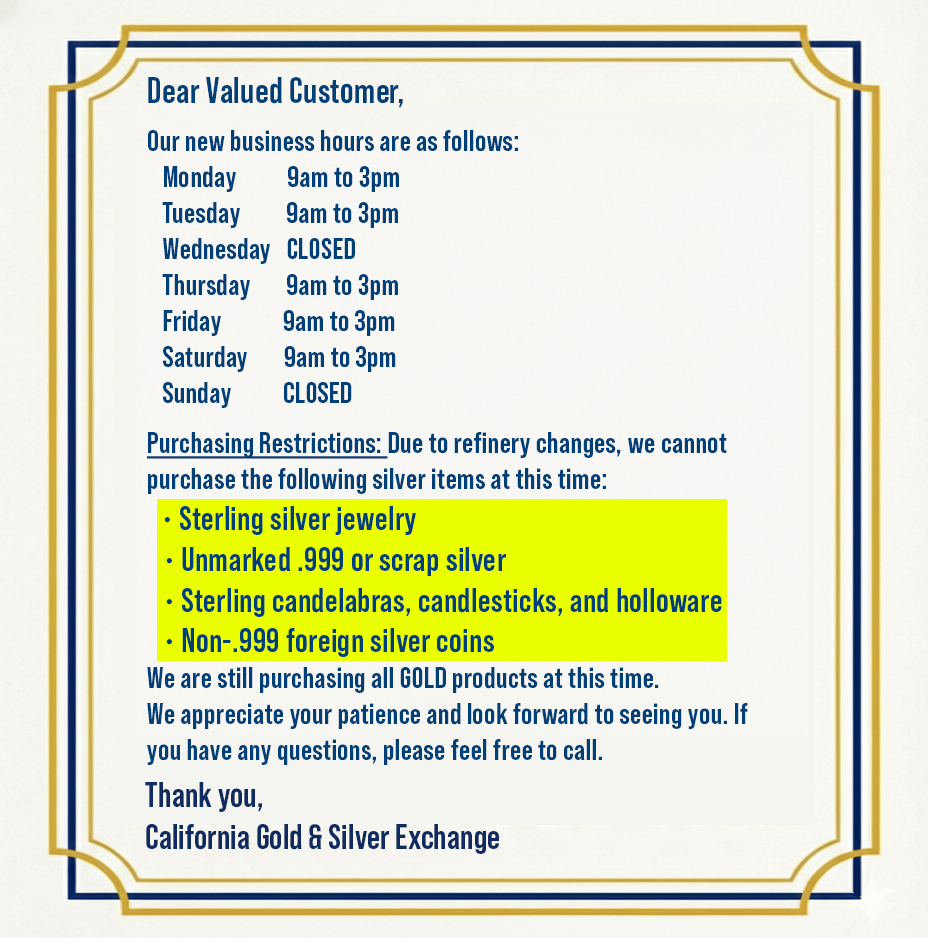

Call (909) 985-4653 for current pricing or to schedule an appointment for a personalized consultation. Or click here for our address and hours.

Check out our Frequently Asked Questions about selling to us Here.