We have received your message. If you indicated that you would like to make an appointment, we will reach out to you shortly.

When you sell gold to us, we will explain every step of the process to help you understand how selling gold works. With your XRF Precious metals Analyzer, we can test your gold to know exactly what purity your gold contains. This helps us assess your gold to give you the most when you sell.

A Self-Directed IRA (SDIRA), sometimes called a Gold IRA, allows you to use alternative assets for your retirement funds such as precious metals like gold, silver, and platinum. Using an SDIRA over a traditional IRA has many benefits. And although in many ways, they work similarly to a regular IRA, there are a few key differences you should be aware of. Always talk to your financial advisor first to see if an SDIRA is a good option for your retirement plan.

How They Work

A gold SDIRA requires that you actually purchase the physical assets, and then store it as part of the investment. Your custodian will manage your account and keep track of all of the assets that you include in your account. The professionals at California Gold and Silver will facilitate the purchase of these assets for your account.

Why You Should Choose an SDIRA

Precious metals, especially gold, are a great option to choose as an asset for your SDIRA. There are many benefits you gain from using an SDIRA over a traditional IRA including:

- You can choose to use pretax or after-tax dollars through a special custodian or through your broker.

- The IRS allows you to purchase gold in any approved physical forms to use as an investment.

- These accounts are separate from any regular IRAs you have set up.

- Gold and other precious metals act as a hedge against inflation.

- Gold and other precious metals hedge your retirement savings against market crashes.

These are just a few of the reasons choosing an SDIRA is a great way to invest in your future, and why using gold for your SDIRA is a great choice for your asset.

What Are the Risks Involved

There are some risks involved when it comes to choosing an SDIRA and investing in precious metals in general. Some things to keep in mind are:

- The price of precious metals is constantly fluctuating.

- SDIRAs often carry higher fees than regular IRAs because they require you to purchase and store physical assets.

- The IRA puts a limit on annual contributions you can make to your SDIRA.

Keep these risks in mind when you are deciding if an SDIRA is right for you. You should always talk to your financial advisor or CPA before making any decisions about your finances.

Get Started with an SDIRA

You can easily get started with your SDIRA at California Gold and Silver Exchange. Or come into our office and fill out a form to start investing in your future. Be sure to talk to your financial advisor before making any monetary decisions.

Sterling silver flatware can be a great way to make some extra cash. However, identifying your flatware to make sure that it’s truly sterling silver can be a little more difficult. Sterling silver is 92.5% silver, which is part of the reason it is so valuable. It can also be refined while keeping its original value. Sterling silver flatware is one item that keeps both its resale value and appeal, which makes it a sought-after item by many collectors and silver traders. In this article, we’ll teach you how to identify your flatware so you can know if what you have is truly sterling silver. Always talk to your CPA or Financial Advisor before making investments.

Look for Indicator Marks

The first thing you can do is check for indicator marks or stamps on your flatware. Usually, sterling silver will have a mark that indicates it as sterling silver. It may also have a British Hallmark that indicates what kind of flatware you have. Another indication that you have true sterling silver is that the flatware pieces are usually darker in color and more lightweight than normal silverware.

Check for Numbers

Another way you can identify if your flatware is sterling silver is by looking for a .925 stamp. Real sterling silver is marked with “.925” because it is 92.5% silver. This is one of the easiest ways to tell if what you have is real sterling silver or not. If your piece is not full sterling silver, it’s likely that you have EPNS (Electroplated Nickel Silver), Nickel Silver, German Silver, Roger’s 1847 Silver, International Silver, or another type of plated silver.

Identify Plated Items

Plated items are items that only have a coating of sterling silver, and are not solid silver. This makes them less valuable than solid sterling silver. If your items are plated, they will often have the words single-plated, double-plated, triple-plated, or quadruple-plated on them. While these items aren’t as valuable as their solid counterparts, they are still extremely durable.

Figure Out if You Have a Set or Individual Pieces

You’ll want to know if you have an entire set of sterling silver flatware or just odd and end pieces. Full sets are more valuable than individual pieces, and therefore, more likely to be on a collector’s radar. Check to make sure all your pieces have the same markings on them. If they don’t, it’s possible that you have some pieces that aren’t a part of the set.

Ready to Sell Your Silver? Contact Us!

California Gold and Silver is a highly-rated gold and silver trader in Upland, CA. If you have sterling silver flatware that you’d like to get appraised, contact us to set up an appointment!

If you’ve got a handful of coins clinking around in your drawers or in a box under your bed, you may be wondering if they are valuable. But how can you tell which coins are worth something? We’re here to tell you which coins are worthless and which ones are valuable. Always talk to your CPA or Financial Advisor before making investments.

Which Coins Are Worthless?

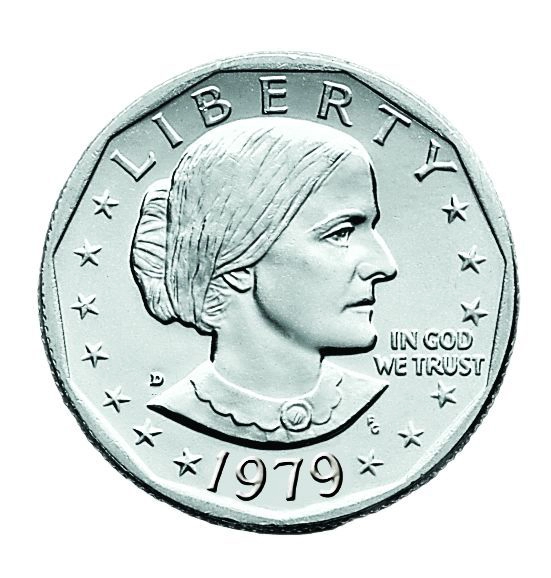

Susan B. Anthony Coins

Susan B. Anthony coins tend not be worth much. There are two reasons that these coins don’t hold much value. The first is that they were extremely common when they were in circulation. It is very rare to come across one that actually has worth to it since so many are common mints. Second, is that there was a lack of interest and confusion when it came to the coins that caused most of the variations to not be in circulation at all. The supply of these coins is very high, while the demand is low. Often, you won’t get more than the face value of the coins.

Sacagawea Coins

Like the Susan B. Anthony coins, the Sacagawea Dollars don’t often hold much value besides the very few rare varieties that exist. These coins are also often only worth their face value, and while they are a great addition to a coin collection, they won’t make you money.

Presidential Dollar Coins

Presidential dollar coins are another type of coin that is only worth its face value. Presidential dollar coins are fairly common on the market and make a fun gift for kids or collectors, but aren’t worth trying to make a sale on. These coins stopped being in production around 2011 because they had a very low demand.

Wheat Back Pennies

Wheat back pennies are coins that are commonly misrepresented as being worth a lot of money, but in reality, they aren’t worth more than a few cents. There are millions of these pennies on the market, and there are only two pennies (the 1909-s and the 1909 BVD) that have value. However, these two pennies are so extremely rare that it’s highly unlikely that you will ever come across one.

Which Coins Are Valuable?

American Flowing Hair Dollar (1794)

The American Flowing Hair Dollar first appeared in 1794, and only lasted until around 1795. The 1795 version is more common than it’s earlier counterpart which makes the 1794 coin extremely valuable.

Draped Bust Half Dollar (1797)

Draped bust half dollars were minted between 1796 and 1807. However, the 1797 draped bust half dollar is a very rare version of the coin with less than 4,000 coins ever minted with only a few hundred still left circulating today.

Liberty Seated Dollar (1870)

Liberty Seated Dollars from 1870 are extremely rare and valuable coins. With only 15 minted of the 1870-S variety, these coins are in high demand and could fetch you over a million dollars if it’s in pristine condition. However, the regular strike 1870 coins are also valued around $100,000 (in pristine condition) and have around 415,000 in circulation.

Morgan Silver Dollar (1889)

It’s possible that you have an 1889 Morgan silver dollar sitting around at home. With over 21 million minted, these coins are valued at around $25,000 if they’re in pristine condition. These coins are also valuable because each mint of these coins has its own distinctive mark.

Any PCGS or NGC Coins

Any coin that is graded by a national grading organization like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC) will have value to it. If you buy coins that are already graded by one of these organizations, it’s likely that your coin has potential resale value that can make you a profit.

Should You Clean Coins Before Selling Them?

You should never clean coins before you sell them. Even if you have a coin that is extremely valuable, cleaning it could greatly diminish the value. Even if your coins are very dirty, you should never attempt to clean them before you bring them to be graded. Professional coin dealers won’t mind that they’re dirty, and they will take the proper steps to remove the dirt if it’s necessary.

Want to Buy or Sell Gold and Silver Coins?

If you have coins that you are ready to sell, or you’re prepared to invest in gold and silver coins, California Gold and Silver can help! You can contact us to schedule an appointment or visit our office in Upland, California. Please feel free to reach out with any questions you may have!