We have received your message. If you indicated that you would like to make an appointment, we will reach out to you shortly.

When you sell gold to us, we will explain every step of the process to help you understand how selling gold works. With your XRF Precious metals Analyzer, we can test your gold to know exactly what purity your gold contains. This helps us assess your gold to give you the most when you sell.

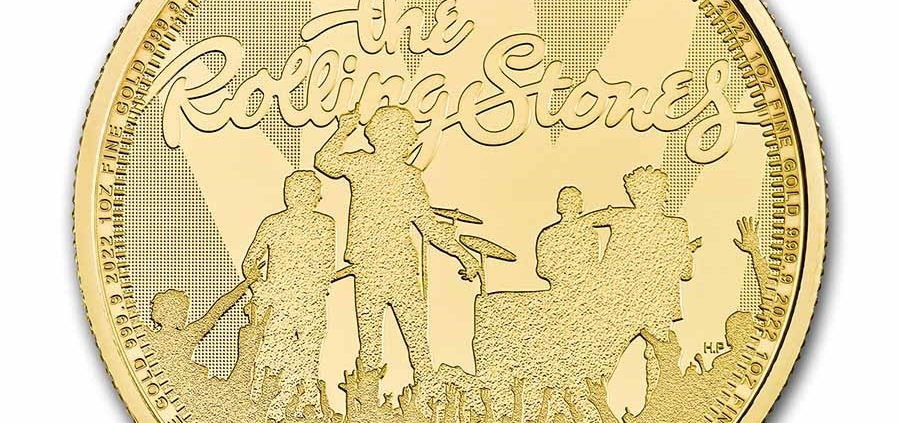

2022 Great Britain Rolling Stones 1 oz Gold Coin

Get your Satisfaction! California Gold and Silver Exchange is excited to be carrying the 2022 Great Britain Rolling Stones 1 oz Gold Coin. This coin is now available for purchase. Get this commemorative coin while supplies last as quantities are limited. Furthermore, Click Here for more information on gold coins we carry.

The reverse side of the 2022 1 oz The Rolling Stones Gold Coin features the iconic band. With 13 UK number-one albums and 8 UK number-one singles, The Rolling Stones will be remembered forever. This beautiful design captures the silhouettes of the band members on stage as a crowd fills the foreground and includes the classic 1973 ‘The Rolling Stones’ font. Along the bottom, “’62-’22” denotes the 60th anniversary of the iconic band’s formation.

The portrait of Her Majesty The Queen by Jody Clark appears on the obverse of the coin. Unlike the gold Britannia, Queen Elizabeth is wearing her royal crown in this depiction.

This coin has been struck in one ounce of 999.9 fine gold and is also available as a quarter-ounce gold, 2oz gold, and 5 oz gold edition along with silver proof editions. The Royal Mint also sells a collorized version of this coin with limited mintage.

Key Points:

- The first time The Rolling Stones have been honored on a UK coin

- Dated 2022 commemorating the band’s milestone 60th Anniversary

- Struck in 999.9 fine gold and finished to Proof like standard

- Features a design that includes the classic 1973 ‘The Rolling Stones’ font

- Created in partnership with The Rolling Stones

Coin Specifications:

Denomination: £100

Alloy: 999.9 Fine Gold

Diameter: 32.69 mm

Mintage: 4000 Coins

Reverse Designer: Hannah Phizacklea

Obverse Designer: Jody Clark

Pure Metal Content: 1 troy ounce

Availability

California Gold and Silver Exchange has secured this new product for purchase in store. We now have a limited quantity of Rolling Stones bullion coins available in store for purchase. Call for current pricing and availability. For more information on coins from Great Britain visit The Royal Mint’s website. Furthermore, for other items available at California Gold and Silver Exchange visit our What We Sell page or call us directly at 909-985-4653 during regular business hours.

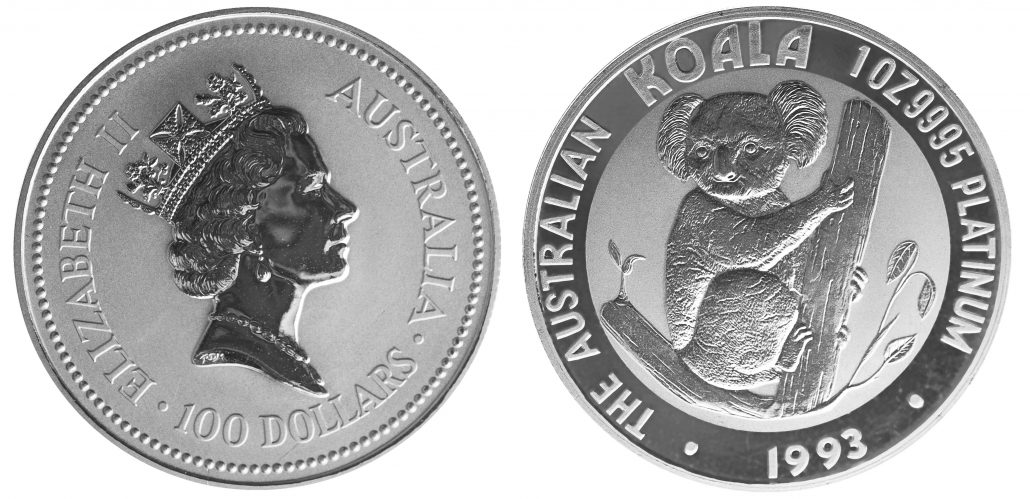

You may find yourself with an excess of silver coins. Or, maybe you’ve been keeping an eye on the silver market prices and you’ve been waiting for the perfect time to sell your coins. Either way, how do you tell if your silver coins are valuable? If you want to be able to have an idea of how much you’ll get for your silver coins before you go to sell them, there are a few ways you can determine their value. Always talk to your CPA or Financial Advisor before making investments.

First, Figure Out if Your Coins Are Bullion or Numismatic

The type of coin you have will help to give you a more accurate idea of how much your coins are worth. Your coins will often be bullion coins or numismatic coins. If you have bullion coins, there are fewer factors that go into determining the value of the coin. This means that it will be easier to get an accurate measure of their value. Bullion coins are purely for investing since they themselves hold a numeric value. On the other hand, numismatic coins are more often collected by collectors and hobbyists.

How to Tell if Your Silver Bullion Coins are Valuable

Silver bullion coins are slightly easier to determine their worth than numismatic coins because bullion coins have a numeric value based on their weight and how much silver they contain.

Purity

Your silver coins should have a stamp on them that says 800, 900, 925, 958, or 999. This stamp will tell you how much silver is in your coin. 999 is 99.9% pure silver while 800 is 80% silver. The higher the purity, the higher the value of your silver coins.

Weight

The weight of your coins is probably one of the most accurate ways to tell if your silver coins are valuable. Since the silver market is measured by weight, you can look at the current price of silver and use that to determine your coin’s value based on how much your coins weigh. Silver is measured in troy ounces, which is a special unit of measurement for gold and silver. Troy ounces are based on 12 ounces to a pound instead of 16 ounces to a pound. One troy ounce is equal to 31.1034768 grams.

How to Tell if Your Numismatic Coins Are Valuable

Numismatic coins are collectibles, which means that there are very specific things that go into the coin’s value. While most collectors will already have an idea of what their coins are worth, people new to collecting may not know what to look for. Since you can’t simply just weigh numismatic coins, you’ll have to do a little bit of research on your coins to tell if your silver coins are valuable.

Number Minted

The number minted refers to how many coins were originally made and therefore how many are on the market. Coins with a lower mint number may be more valuable since they are rarer.

Grade and Quality

The grade or quality of your coin also plays a part in determining how much your coins are worth. Coins in better condition are often more valuable than ones that are damaged or flawed. The grade and quality of your coins is not equal to the cleanliness of your coins, and you should never clean your coins before you sell them.

Demand

Lastly, another important thing to research when figuring out if your coins are worth anything is to check their demand. Coins in high demand will be more valuable than those that are not in demand. You can easily do a quick online search to see if your coins are in demand. While you don’t ever want to sell your coins on websites like Ebay, you can use the website to see how much the coins are going for and if there is a high demand for them.

We Buy and Sell Silver Coins

We buy and sell many different kinds of silver coins. Silver coins of note that we are currently buying are:

Silver Dollar Coins

- Morgan

- Peace

- American Silver Eagle.

- Silver Eisenhower Dollars (Blue Ike or Brown Ike – however, they must be in this special set)

Wartime Silver Nickels

We buy wartime silver nickels. We buy coins in the years 1942-P and 1942-S to 1945. Wartime silver nickels look dirty and are 35% Silver.

Silver Coins We Do Not Buy

We do not buy Susan B. Anthony, Sacagawea, or Presidential Dollar Coins.

Silver Coins We Sell

We currently have a stock of 2023 Silver Britannia with Kings Charles coins for sale.

Ready to Buy or Sell?

If you are ready to buy silver coins or sell your silver coins, you can schedule an appointment with us. Please don’t hesitate to contact us if you have any other questions.

When you start to invest in gold and diamonds, it’s important to know the terminology associated with each trade. Each of these investment opportunities uses karats or carats as a form of measurement. However, there are a few differences in how carats and karats are measured.

Carats

Carats are a unit of measurement used specifically for diamonds. While most people believe that carat refers to the size of the diamond, it actually refers to the weight. One carat is equal to 200 milligrams. While diamonds are priced on their weight, or how many carats they are, they are also priced based on their cut, clarity, and color.

Karats

Unlike carats, karats don’t refer to the weight of gold, but they instead refer to their purity. Gold ranges from 9 karats to 24 karats with 24 karats being 100% pure gold. Often, people will choose 14-karat gold for jewelry since it is extremely durable and more affordable than other karats. 14-karat gold is about 60% pure gold and 40% other metals. 18-karat gold is another popular choice since it is about 75% pure gold. 18-karat gold also has gorgeous color quality and is very durable. Since 18-karat gold has a very high gold content, it is less likely to irritate the skin.

…Carrots?

Carrots are a delicious root vegetable, and a great healthy choice to add to a meal. They also make a delicious snack on their own!

We Buy Gold, Silver, and Diamonds

If you have gold, silver, and diamonds you’d like to sell, you can bring them into CA Gold and Silver Exchange in Upland, California. We will test, weigh, and price your coins, bullion, and jewelry in our store. We also sell coins and bullion if you are looking to purchase or start investing. If you have questions, don’t hesitate to contact us.