We have received your message. If you indicated that you would like to make an appointment, we will reach out to you shortly.

When you sell gold to us, we will explain every step of the process to help you understand how selling gold works. With your XRF Precious metals Analyzer, we can test your gold to know exactly what purity your gold contains. This helps us assess your gold to give you the most when you sell.

With gold at near record prices, now is the time to bring in your gold scrap — old or unused gold that you own — and cash in on it.

Whether it’s broken jewelry, dental fillings, or old coins, you can turn these items into cash quickly and easily. And now’s the time to do so for maximum profit.

Common Examples of Gold Scrap

Here are some common examples of items that have value as gold scrap:

- Broken Jewelry. If you have broken or outdated gold jewelry sitting in your drawer, it’s time to turn it into cash. This includes rings, chains, bracelets, earrings, charms, and pendants that are no longer wearable or fashionable.

- Dental Gold. Dental fillings, crowns, and bridges often contain gold and other precious metals. Even small amounts of dental scrap can add up to significant value when sold to a reputable buyer.

- Old Coins. You can get a premium price when selling rare or collectible coins made of gold. But you also can sell common coins containing gold for their metal value. Check your coin collection for any gold coins you may have inherited or acquired over the years.

- Gold Watches. If you have broken or unwanted gold watches, whether they are designer brands or generic timepieces, you can sell them for their gold content as well.

- Gold Bullion. If you have invested in gold bars or coins as a hedge against economic uncertainty, you can sell them when prices are high to capitalize on your investment.

The Process of Selling Gold Scrap

If you’re ready to cash in on your gold by selling it, here’s the process for doing so:

- Research Potential Buyers. Start by researching reputable gold buyers in your area or online. For example, California Gold & Silver Exchange is located in Upland CA and serves Upland, Glendora, Ontario, La Verne, Montclair, Claremont, and San Dimas. Look for a local business with positive reviews, transparent pricing, and a commitment to fair and ethical practices.

- Gather Your Gold Scrap. Collect all your gold scrap items and separate them by karat purity if possible. Gold purity is measured in karats, with 24 karats being pure gold and lower karat values indicating a lower gold content. For example, 14 karats is 58.5% purity, while 8 karats is 33.3%.

- Get an Appraisal. Take your gold scrap to a reputable buyer for appraisal. The buyer will evaluate the purity and weight of your gold items to determine their value. Make sure the buyer uses accurate and up-to-date scales and testing methods. As a point of reference, California Gold & Silver Exchange uses an XRF X-ray Analyzer to properly evaluate your gold scrap.

- Receive an Offer. Once your gold has been appraised, the buyer will make you an offer based on the current market price of gold and the purity of your items. You are under no obligation to accept the offer if you are not satisfied with the price.

- Negotiate if Necessary. If you feel the offer is too low, don’t hesitate to negotiate for a higher price. However, keep in mind that the buyer needs to make a profit as well, so be realistic in your expectations.

- Get Paid. Then, if you accept the offer, you will receive payment for your gold scrap. Depending on the buyer, you may receive cash, a check, or a bank transfer. Make sure to get a receipt for your transaction.

- Consider Your Options. If you’re not in immediate need of cash, consider holding onto your gold scrap until prices rise even further. However, keep in mind that gold prices can be volatile, so it’s essential to weigh the potential risks and rewards.

Cash in on Your Gold Scrap Today!

With gold prices near record highs, there has never been a better time to sell your gold scrap for cash. So, follow the steps outlined above to ensure a smooth and profitable selling experience. And don’t hesitate to reach out to trusted gold buyers like California Gold & Silver Exchange to get the best price for your gold scrap.

Call (909) 985-4653 or click here to contact us for current prices.

Check out our FAQs for more answers about selling gold scrap.

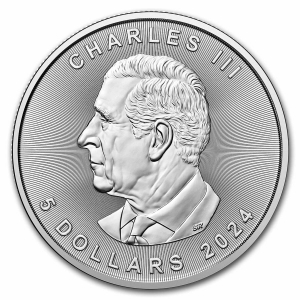

The new 2024 Silver Maple Leafs are highly collectible and historically significant because for the first time ever the front face has a monarch other than Queen Elizabeth II gracing it.

Canada’s signature silver bullion coin is one of the world’s most iconic and instantly recognizable coins. Since its introduction in 1988, the coin has featured a maple leaf on the reverse and Queen Elizabeth II on the face.

Instead of Queen Elizabeth II (who passed away in on Sept. 8, 2022), this year’s coin introduces the first Canadian effigy of King Charles III. His Majesty King Charles III was officially proclaimed King of Canada on Sept. 10, 2022.

Why a Maple Leaf?

The maple leaf has been Canada’s national symbol since the 1800s. Canadian pennies started featuring maple leaves in the 1850s. Then from 1876 to 1901, the maple leaf appeared on all Canadian coins.

Of course, the maple leaf isn’t just used on coins. It’s also a symbol of Canadian identity. In 1868, it was used on the Ontario and Quebec coat of arms. It was on the Olympic uniforms of Canadian athletes beginning in 1908. It was featured on Canadian military uniforms and equipment in both World Wars. And it was put on the country’s new national flag in 1965.

It’s said that the distinctive maple leaf signifies pride, connection, and community.

Highlights of the 2024 Silver Maple Leafs

Here are some coin highlights:

- Each one-ounce 2024 Silver Maple Leaf is $5 Canada legal tender.

- The Silver Maple Leafs are minted at the Royal Canadian Mint.

- The coins are highly pure 99.99% fine silver.

- The smaller leaf below and slightly to the right of the centerpiece maple leaf is micro-engraved with the number 24 and serves as advanced anti-forgery protection against counterfeiters.

Get Your 2024 Silver Maple Leafs Today

Silver Maple Leafs are always in high demand with collectors, but with the historical significance of the 2024 Silver Maple Leafs, demand is expected to be heavy. So, get yours today!

Call (909) 985-4653 or click here to contact us for current prices.

When the economy is uncertain and markets fluctuate, many investors turn to precious metals as a more reliable option, but knowing how to get started with investing in precious metals is a critical first step.

Investing in precious metals like gold and silver offers a hedge against inflation, currency devaluation, and geopolitical instability. But there are specific strategies involved for investing in gold and silver, as well as important considerations for newcomers to the market.

Overview of Investing in Precious Metals

Investing in precious metals involves purchasing physical assets such as gold, silver, platinum, and palladium. These metals have been valued throughout history for their rarity, durability, and intrinsic worth.

Unlike stocks or bonds, which can be influenced by economic conditions and company performance, the value of precious metals is largely independent of these factors.

Benefits of Investing in Precious Metals

There’s a reason that so many people continue to invest in precious metals. Actually, there are several reasons. Here are some of the benefits of doing so:

- Diversification: Precious metals provide diversification within an investment portfolio, reducing overall risk.

- Inflation Hedge: Historically, precious metals have retained their value during times of inflation, making them a reliable hedge against currency devaluation.

- Store of Value: Gold and silver have been recognized as stores of value for thousands of years, offering stability in uncertain economic environments.

- Liquidity: Precious metals are easily bought and sold, providing investors with liquidity when needed.

Investing in Gold

Gold is the most popular precious metal for investors. Its popularity is due to its scarcity and enduring value. Plus, you can buy gold in various forms, including coins and bars.

Gold coins, such as American Eagles or Canadian Maple Leafs, are minted by government agencies and are highly recognizable and easy to trade.

Gold bars, typically available in various weights ranging from grams to kilograms, offer investors a cost-effective way to acquire larger quantities of gold.

Investing in Silver

Silver is another attractive option for investors seeking exposure to precious metals. Like gold, silver can be purchased in the form of coins or bars.

Silver coins that are popular investments include the American Silver Eagle and the Austrian Philharmonic, known for their purity and quality.

Silver bars are available in various sizes and are an affordable option for investors looking to diversify their portfolios.

Things to Consider When Investing in Precious Metals

Before you get started with investing in precious metals, here are some things to consider:

- Storage and Security. Consider how you will store your precious metals to ensure their safety and security.

- Market Conditions. Keep an eye on market trends and factors influencing the price of precious metals, such as interest rates and geopolitical events.

- Dealer Reputation. Choose a reputable dealer with a track record of reliability and transparency.

- Factor in transaction costs, premiums, and potential taxes when purchasing precious metals.

Start Investing in Precious Metals Today!

Investing in precious metals offers stability and diversification in an ever-changing financial landscape. Plus, buying gold and silver provides valuable opportunities to safeguard your wealth and preserve purchasing power for the future.

Contact the experts at California Gold & Silver Exchange to learn more about how you can start building your investment portfolio with gold and silver. With their guidance and expertise, you can navigate the complexities of the precious metals market and make informed investment decisions.

Call (909) 985-4653 or click here for more ways to contact us.