We have received your message. If you indicated that you would like to make an appointment, we will reach out to you shortly.

When you sell gold to us, we will explain every step of the process to help you understand how selling gold works. With your XRF Precious metals Analyzer, we can test your gold to know exactly what purity your gold contains. This helps us assess your gold to give you the most when you sell.

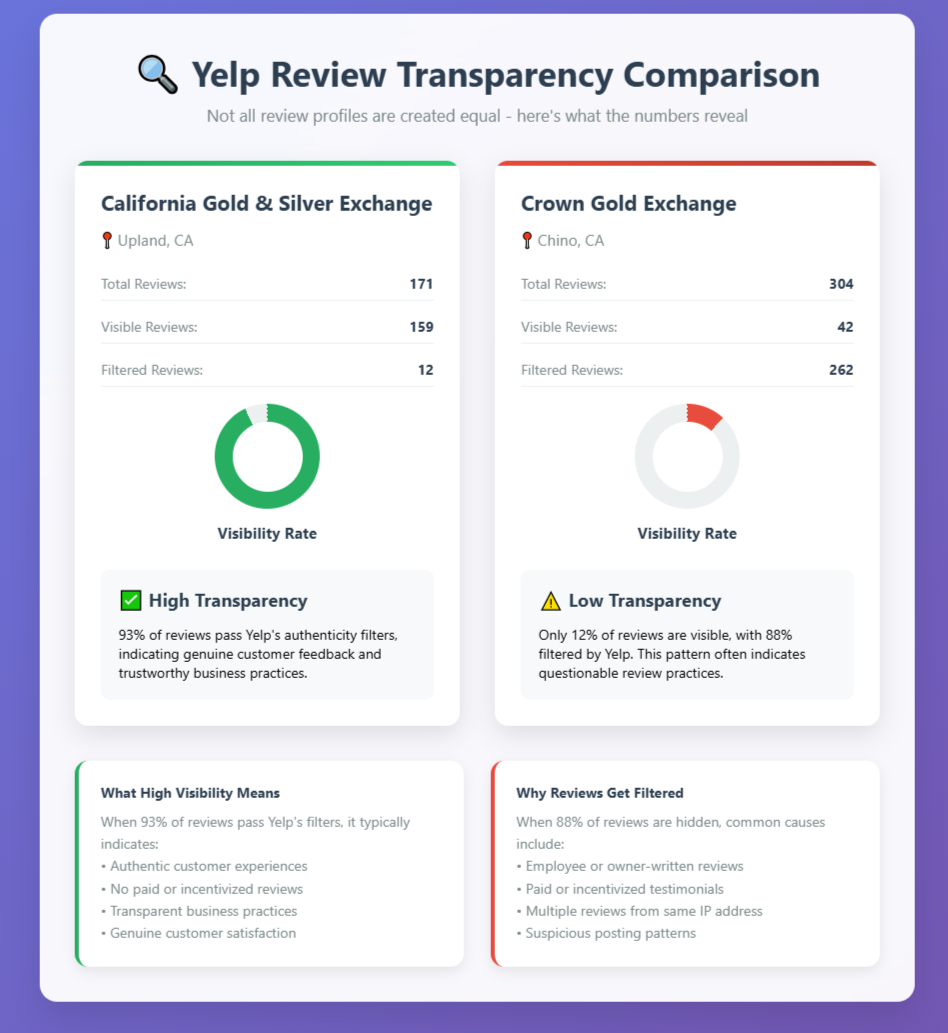

How to Know if Yelp Reviews Are Real: Hidden Filters, Fake Reviews & What They Really Mean

When you’re looking to sell gold, silver, or other precious metals, online reviews can make or break your decision about which dealer to trust. With thousands of dollars potentially at stake, you want to work with a reputable business that treats customers fairly and offers competitive prices.

But here’s the problem: not all Yelp reviews are what they seem. In fact, many businesses manipulate their online reputation through fake reviews, paid testimonials, and other deceptive practices that can mislead potential customers.

Consider this eye-opening comparison: California Gold & Silver Exchange in Upland shows 93% of their total reviews publicly, while Crown Gold Exchange in Chino shows only 12% of their reviews. What happened to the other 88% of Crown Gold’s reviews? They’ve been filtered by Yelp’s algorithm—and there’s usually a good reason why.

Yelp’s Filter System: What Most People Don’t Know

Yelp uses a sophisticated algorithm to filter out reviews it considers suspicious, fake, or unreliable. This filtering system is designed to protect consumers from misleading information, but most people don’t even know it exists.

Here’s what you need to understand about Yelp’s filtering:

Filtered reviews don’t count toward the overall star rating. A business might have 300 total reviews, but if 200 are filtered, only 100 count toward their displayed rating.

Filtered reviews are still visible—if you know where to look. At the bottom of every Yelp business page, there’s a small link that says “filtered reviews” or “reviews that are not currently recommended.” Click this link to see what Yelp has hidden.

The filtering happens automatically. Yelp’s algorithm looks for patterns that suggest fake or manipulated reviews, including:

- Multiple reviews from the same IP address

- Reviews from accounts with suspicious activity

- Content that appears to be written by business owners or employees

- Reviews that follow unnatural patterns or timing

Most consumers never scroll down to find this filtered content, which means they’re making decisions based on incomplete information.

A Real Example: Transparency in Action

Let’s examine two local precious metals dealers to see how Yelp filtering reveals important differences in business practices:

California Gold & Silver Exchange (Upland):

- Visibility rate: 93%

- Total reviews: 171

- Visible reviews: 159

- Filtered reviews: 12

A Competitor (Chino):

- Total reviews: 304

- Visible reviews: 42

- Filtered reviews: 262

- Visibility rate: 12%

This stark difference raises important questions. Why would Yelp filter 86% of one business’s reviews while allowing 93% of another’s to remain visible?

The answer typically lies in review quality and authenticity. When a business has an unusually high percentage of filtered reviews, it often indicates:

- Incentivized or paid reviews

- Reviews written by employees or business owners

- Coordinated review campaigns

- Other manipulative practices

Businesses with transparent review profiles, like California Gold & Silver Exchange, tend to have much higher visibility rates because their reviews come from genuine customers sharing authentic experiences.

How to Spot Fake Yelp Reviews

Even among visible reviews, some may still be questionable. Here are red flags to watch for:

Content Warning Signs:

- Extremely short, generic comments like “Great service!” or “Highly recommend!”

- Overuse of business names or keywords (clear SEO manipulation)

- Overly emotional language without specific details

- Perfect grammar in reviews from accounts that otherwise show poor writing skills

Reviewer Profile Red Flags:

- No profile photo or obvious stock photos

- Account created recently with only one review

- History of only 5-star reviews across different industries

- Multiple reviews posted on the same day across different businesses

Timing Patterns:

- Sudden bursts of positive reviews around business launches or promotions

- Multiple reviews posted within hours of each other

- Reviews that respond to specific negative feedback (damage control)

Geographic Inconsistencies:

- Reviews from users in distant locations for local businesses

- Multiple reviews from users in the same small geographic area for a regional business

Yelp Secrets: How to Read Reviews Like a Pro

Most people simply look at star ratings and read a few recent reviews. But there are insider techniques that reveal much more about a business’s true reputation:

Most people simply look at star ratings and read a few recent reviews. But there are insider techniques that reveal much more about a business’s true reputation:

1. Always Check Filtered Reviews Scroll to the bottom of any Yelp page and click on filtered reviews. These often contain the most honest feedback because they haven’t been curated or manipulated.

2. Examine Reviewer Profiles Click on reviewer names to see their history. Real customers typically have:

- Multiple reviews across different businesses

- Photos and detailed profiles

- Consistent writing style and local geographic focus

- A mix of ratings (not just 5-stars)

3. Look for Photo Evidence Reviews with photos are much more likely to be authentic. Real customers often share pictures of their experience, products, or the business location.

4. Read the Middle-Range Reviews 3-star and 4-star reviews often provide the most balanced, honest feedback. They’re less likely to be fake because most businesses don’t pay for mediocre reviews.

5. Check Response Patterns Notice how businesses respond to negative reviews. Professional, helpful responses suggest good customer service, while defensive or aggressive responses are red flags.

6. Analyze Review Dates Look for natural patterns in review timing. Authentic businesses receive reviews steadily over time, while suspicious businesses often show clusters of reviews around specific dates.

Why Transparent Review Profiles Matter

When choosing a precious metals dealer, review transparency matters for several reasons:

Authentic Feedback: Businesses with high visibility rates are more likely to show genuine customer experiences, both positive and negative.

Trustworthy Practices: Companies that don’t manipulate reviews typically don’t manipulate other aspects of their business either.

Real Problem Resolution: You can see how businesses handle complaints and whether they actually resolve customer issues.

Accurate Expectations: Unfiltered reviews give you a realistic picture of what to expect from your experience.

California Gold & Silver Exchange’s 93% review visibility rate demonstrates this transparency in action. Customers can read authentic feedback from real transactions and make informed decisions based on genuine experiences.

Beyond Yelp: Diversifying Your Research

While Yelp can be valuable when used correctly, smart consumers don’t rely on a single review platform:

- Google Reviews: Often less filtered than Yelp, though still subject to manipulation

- Better Business Bureau: Provides complaint resolution history and accreditation status

- Industry-Specific Sites: Precious metals forums and communities often share dealer experiences

- Word of Mouth: Personal recommendations from friends and family remain highly valuable

Red Flags in Precious Metals Reviews

When evaluating gold and silver dealers specifically, watch for these warning signs in reviews:

Pricing Concerns:

- Complaints about low buyback prices with no explanation

- Reviews mentioning hidden fees or changed quotes

- Stories about pressure tactics or rushed transactions

Professionalism Issues:

- Multiple mentions of unprofessional staff behavior

- Complaints about cleanliness or security of the facility

- Reviews describing disorganized or chaotic operations

Business Practice Problems:

- Stories about changed terms after agreements

- Complaints about difficulty getting items back

- Reviews mentioning questionable business licensing or credentials

Making Smart Decisions

The goal isn’t to find perfect reviews—every business will have some negative feedback. Instead, look for:

- Consistent Patterns: Do most customers report similar positive experiences?

- Professional Responses: How does the business handle complaints publicly?

- Specific Details: Do reviewers mention specific staff members, processes, or outcomes?

- Recent Activity: Are there current reviews showing the business is actively serving customers?

Conclusion: Trust What You Can Verify

Yelp reviews can be a valuable tool for choosing a precious metals dealer, but only when you understand how to read them properly. By checking filtered reviews, examining reviewer profiles, and looking for authentic patterns, you can cut through the noise and find businesses that truly serve their customers well.

The difference between a 93% review visibility rate and a 12% rate isn’t just a statistic—it’s a reflection of business practices and customer satisfaction. When you’re dealing with valuable assets like gold and silver, this transparency matters.

Before making your next precious metals transaction, take the time to properly research your options. Check the filtered reviews, examine the patterns, and choose a dealer whose online reputation reflects genuine customer satisfaction rather than manufactured marketing.

Your gold and silver deserve a dealer you can trust—and now you know how to find one.

Ready to experience transparent, honest precious metals dealing? Visit California Gold & Silver Exchange in Upland and see why 93% of our customer reviews pass Yelp’s authenticity filters. Our reputation speaks for itself because our customers speak for us.

Maximize your visit to California Gold & Silver Exchange

Whether you’re visiting us to sell gold, silver, coins, or other valuables—or you’re looking to purchase precious metals—you’ll want to make the most of your time with us. Here’s what you should know before stopping by.

1. Bring It All—We’ll Test It All

If you think it might have value, bring it in.

We encourage customers to bring multiple items during their visit. Whether it’s jewelry, coins, bullion, or even items you’re unsure about—our in-house experts will test everything using advanced, non-destructive technology like our XRF X-Ray Analyzer to ensure accuracy, transparency, and trust.

Even if you’re uncertain about the item’s composition or value, we’ll evaluate it for you with no obligation.

2. Review What We Buy (and What We Don’t)

To save time, we recommend checking our What We Buy page. Here’s a quick overview:

✅ Items We Commonly Buy:

- Gold, silver, and platinum jewelry (even broken pieces)

- Gold and silver bullion (coins and bars)

- Sterling silver flatware and serving pieces

- Rare and collectible coins

- Dental gold, class rings, and more

❌ Items We Don’t Buy:

- Gold-plated or costume jewelry

- Electronics, watches, or non-precious stones

- Items with no precious metal content

When in doubt—bring it in! We’re happy to give you a clear answer.

3. Selling to Us is Simple and Transparent

We’ve made the selling process quick, honest, and straightforward. Here’s how it works:

- Bring in your items – no appointment necessary.

- We test everything in front of you, using our XRF Analyzer for fast and accurate readings.

- We make you a real-time offer based on current market prices.

- If you accept, you get paid on the spot.

Learn more: How Selling Works

4. How We’re Different from “The Other Guys”

Not all gold buyers are created equal. At California Gold & Silver Exchange:

- No pressure, no gimmicks.

- Transparent testing, done right in front of you.

- Real-time spot pricing, not flat-rate pricing.

- We don’t lowball—we believe in fair, honest payouts.

Compare us directly: Why We’re Different

5. Thinking About Buying? Here’s What to Know

We offer a wide variety of investment-grade precious metals and rare coins.

Whether you’re starting your precious metals portfolio or adding to it, we carry:

- Gold and silver bullion (American Eagles, Maple Leafs, bars, and more)

- Collectible and numismatic coins

- Fractional gold, platinum, and more

Explore our current inventory: What We Sell

Need help choosing? Our knowledgeable staff will guide you based on your budget, goals, and interests.

6. FAQs: Get Answers Before You Visit

You’ll find helpful information about buying and selling on our FAQ pages:

Find answers to questions like:

- What forms of ID do I need?

- How is the value of my gold calculated?

- Can I buy small or large quantities?

7. Read This First – A Message from Us

Before your visit, we invite you to read this quick message from our team. It outlines our values:

✔ Transparency

✔ Respect

✔ Fair Pricing

✔ Customer-first service

Make it a Road Trip? If you’re driving a fair distance to come to our store, which many people do, why not make a day out of it?

Stop In and See the Difference

We’re here to help you get the best value—whether you’re buying, selling, or simply curious. Walk in with confidence, and walk out knowing you got an honest deal.

Visit us today at California Gold & Silver Exchange in Upland, CA. No appointment necessary. Have questions before you arrive? Give us a call—we’re happy to help.

While politics can be a divisive issue, we understand everyone’s perspective is valid and is shaped by deeply personal factors. But one thing is certain: For decades, our clientele has been dominated by conservative investors, attracted to gold for its independence from government influence and its reliability as a hedge against inflation.

But something interesting is happening in today’s precious metals market. A more politically diverse group of investors is entering the gold space, including a growing number of liberal and progressive investors who previously might have overlooked physical precious metals in favor of stocks, bonds, or alternative investments.

So what’s driving this shift? Why are more Democrats now buying gold, and what does this mean for the broader precious metals market?

A Historical Trend: Why Conservatives Traditionally Invest in Gold

To understand today’s changing dynamics, it’s worth examining gold’s traditional investor base. Conservative investors have long been drawn to precious metals for reasons that align closely with their core financial values.

Gold represents financial independence—it’s an asset that exists outside the traditional banking system and government control. For investors who value self-reliance and are skeptical of fiat currency, gold provides a tangible alternative that has maintained value for thousands of years.

Conservative investors have also historically used gold as a hedge against what they perceive as fiscal irresponsibility. Whether concerned about mounting national debt, expansive monetary policy, or the long-term effects of government spending, gold has served as insurance against currency debasement and inflation.

This appeal extends beyond pure economics. Gold represents a return to sound money principles, offering stability in an era of digital currencies and complex financial instruments that many traditional investors view with suspicion.

Do Liberals Buy Bullion? Changing Trends in the Modern Market

The short answer is yes—and increasingly so. While precious metals have traditionally skewed conservative, a new wave of Democrat and left-leaning investors are entering the gold market with their own compelling reasons.

This shift reflects several converging factors that transcend traditional political boundaries. Economic volatility over the past few years has affected investors regardless of their political affiliation. The pandemic-era market swings, followed by persistent inflation concerns, have prompted many progressive investors to reconsider their portfolio allocation.

Rising inflation has been particularly influential. Democrats who have watched their purchasing power erode despite strong stock market performance are discovering what conservative investors have long known: gold can serve as an effective hedge against currency debasement.

There’s also growing distrust in traditional financial institutions across the political spectrum. While conservatives have long been skeptical of big banks, many progressives now share similar concerns about Wall Street’s role in wealth inequality and market manipulation. For these investors, gold represents a way to store wealth outside of systems they view as fundamentally unfair or risky.

Perhaps most interestingly, many socially-conscious investors are finding that gold fits well within diversified portfolios that already include ESG investments and cryptocurrency. Tech-savvy millennials and Gen Z investors who grew up with digital assets are surprisingly comfortable with the concept of alternative stores of value—including physical precious metals.

Stats: Who Actually Buys Gold? A Look at Investor Demographics

Recent polling data reveals fascinating insights about gold ownership across political lines. While comprehensive demographic breakdowns by political affiliation remain limited, available data suggests the precious metals market is more diverse than many assume.

Gallup polling has shown that gold ownership spans all political affiliations, with variations more closely tied to age and income than partisan identity. Younger investors, regardless of political leaning, show increasing interest in alternative assets including both cryptocurrency and precious metals.

Geographic patterns also tell an interesting story. While rural and inland areas have traditionally shown higher gold ownership rates, coastal urban areas—typically more Democratic—are seeing increased precious metals investment. This reflects the growing sophistication of urban investors who are incorporating gold into diversified portfolios.

Income demographics reveal that gold ownership increases with wealth across all political affiliations. However, the entry point for gold investment has become more accessible, with fractional ownership options and lower minimum purchases attracting a broader range of investors.

The most significant trend is generational. Millennials and Gen Z investors, who lean more Democratic than previous generations, are driving much of the growth in alternative asset classes, including precious metals.

Economic Uncertainty: Why Democrats Are Increasingly Turning to Gold Today

Several specific factors are driving increased Democratic interest in gold investment:

Post-Pandemic Economic Concerns: The massive fiscal and monetary response to COVID-19 has created concerns about long-term inflation and currency stability that transcend political boundaries. Democrats who supported necessary pandemic relief measures are nonetheless concerned about the long-term economic consequences.

Environmental and Economic Instability: Climate change and environmental concerns are creating new types of economic uncertainty. Progressive investors are recognizing that physical assets like gold may provide stability in an era of increasing environmental and social volatility.

Portfolio Diversification Beyond Tech: Many Democratic investors have historically favored technology stocks and growth investments. However, recent tech sector volatility has prompted broader diversification strategies that include precious metals alongside renewable energy and ESG investments.

Cryptocurrency Integration: Interestingly, many progressive investors who embraced cryptocurrency are finding that gold complements their digital asset holdings. Both represent alternatives to traditional fiat currency, and many investors now hold both as hedges against different types of systemic risk.

Disillusionment with Traditional Finance: Growing awareness of wealth inequality and systemic financial risks has led many Democrats to seek alternatives to traditional banking and investment products. Gold represents a way to store wealth outside of systems they may view as problematic.

Common Ground: What All Gold Investors Value

Despite different motivations, investors across the political spectrum share fundamental reasons for choosing precious metals:

Wealth Preservation: Whether concerned about government overreach or corporate malfeasance, all gold investors share a desire to protect their wealth from systemic risks.

Portfolio Diversification: Modern portfolio theory applies regardless of political affiliation. Gold’s low correlation with stocks and bonds makes it valuable for any investor seeking to reduce overall portfolio risk.

Tangible Assets: In an increasingly digital world, there’s growing appeal across political lines for assets you can physically hold. This desire for tangibility spans from conservative preppers to progressive investors skeptical of digital financial systems.

Uncertainty Hedge: Political and economic uncertainty affects everyone. Gold serves as insurance against various types of systemic risk, from currency collapse to geopolitical instability.

Independence: Whether seeking independence from big government or big corporations, gold offers a way to store value outside of traditional systems.

How to Get Started: What Every First-Time Gold Buyer Should Know

For investors new to precious metals, regardless of political affiliation, several key principles apply:

Start with Reputable Dealers: Work with established, local precious metals dealers who can provide education, fair pricing, and ongoing support. Local dealers like California Gold & Silver Exchange offer the advantage of face-to-face relationships and community accountability.

Understand Your Options: Physical gold comes in various forms—coins, bars, and rounds—each with different premiums, liquidity characteristics, and storage requirements. Government-minted coins like American Eagles offer high liquidity and recognition, while bars may offer lower premiums for larger purchases.

Plan for Storage: Physical precious metals require secure storage. Options range from home safes to bank safety deposit boxes to professional storage facilities. Consider your comfort level, insurance needs, and accessibility requirements.

Start Small and Learn: Begin with a modest allocation—many advisors suggest 5-10% of a portfolio—and increase your knowledge and holdings over time. This allows you to understand the market dynamics without overcommitting.

Verify Authenticity: Learn to identify authentic precious metals and work with dealers who provide proper documentation and guarantees. Counterfeit precious metals are a real concern in today’s market.

Consider Dollar-Cost Averaging: Like any investment, precious metals prices fluctuate. Regular, smaller purchases can help smooth out price volatility over time.

Conclusion

The growing political diversity in precious metals investment reflects a maturing market and changing economic realities. While conservatives have long understood gold’s value as a hedge against government overreach and currency debasement, progressives are now discovering their own compelling reasons for precious metals ownership.

Whether motivated by inflation concerns, portfolio diversification, environmental uncertainty, or skepticism toward traditional financial systems, investors across the political spectrum are finding common ground in gold’s fundamental value proposition: preserving wealth in uncertain times.

This convergence suggests that precious metals investment is evolving from a politically-tinged decision to a mainstream financial strategy. As economic uncertainty continues and traditional investment approaches face new challenges, gold’s appeal as a non-partisan safe haven is likely to grow.

For investors considering precious metals for the first time, the key is education and working with reputable dealers who can provide guidance regardless of your political perspective. In an era of increasing polarization, gold remains one of the few assets that offers value to investors across the entire political spectrum.

The question isn’t whether you’re liberal or conservative—it’s whether you’re prepared for economic uncertainty. And increasingly, Americans of all political stripes are finding that gold provides an answer.