Is it Better to Own Cash or Gold?

In times of economic uncertainty, the question — is it better to own cash or gold? — is particularly relevant. Both cash and gold offer unique advantages and come with their own set of risks.

Deciding which is better for you depends on your financial goals, risk tolerance, and market outlook.

Benefits vs. Risks of Owning Cash

Here are some of the benefits and potential risks of holding cash as an asset:

Benefits of Owning Cash

- Liquidity: Cash is the most liquid asset, allowing for immediate access to funds for daily expenses, emergencies, or investment opportunities.

- Stability: Cash offers stability in value, as it is not subject to market fluctuations like stocks or other investments.

- Security: In a stable economic environment, cash can provide a sense of security and predictability.

Risks of Owning Cash

- Inflation: Over time, inflation erodes the purchasing power of cash. As the cost of goods and services rises, the real value of cash diminishes.

- Low Returns: Cash typically offers low returns, especially in savings accounts or low-yield investments, which may not keep pace with inflation.

- Opportunity Cost: Holding large amounts of cash means missing out on potential gains from higher-yielding investments.

Benefits vs. Risks of Owning Gold

On the other hand, here are the benefits and risks of investing in gold:

Benefits of Owning Gold

- Hedge Against Inflation: Gold is often seen as a hedge against inflation, maintaining its value over time as the purchasing power of cash declines.

- Safe Haven Asset: During times of economic or geopolitical uncertainty, gold is perceived as a safe haven, often increasing in value when other assets decline.

- Diversification: Gold can diversify an investment portfolio, reducing overall risk and volatility.

Risks of Owning Gold

- Price Volatility: Gold prices can be volatile, influenced by market demand, geopolitical events, and economic conditions.

- Storage and Security: Physical gold requires secure storage, which can incur additional costs and logistical considerations.

- No Yield: Unlike stocks or bonds, gold does not generate interest or dividends, which means it relies solely on price appreciation for returns.

Which Type of Wealth/Investment is Best for You?

Determining whether to hold cash or gold depends on your individual financial situation and investment goals. While you should always consult with a financial professional for advice and guidance, here are some factors to consider:

- Financial Goals. If your primary goal is to preserve purchasing power and protect against inflation, gold may be a better choice. For immediate liquidity and short-term financial needs, cash is more suitable.

- Risk Tolerance. If you have a low risk tolerance and prefer stability, holding cash may provide peace of mind. If you are comfortable with market fluctuations and seek potential long-term gains, investing in gold can be advantageous.

- Investment Horizon. For short-term needs or goals, cash is more appropriate due to its liquidity. For long-term wealth preservation and portfolio diversification, gold can play a valuable role.

- Market Conditions. Assess current economic conditions and market outlook. In times of high inflation or economic instability, increasing your gold holdings can provide a hedge. During stable economic periods, holding more cash may be beneficial.

Both cash and gold have their place in a well-rounded investment strategy. Cash provides liquidity and stability, while gold offers protection against inflation and economic uncertainty.

At California Gold & Silver Exchange, we specialize in helping you make informed investment decisions. Contact us today to learn more about buying gold, including current prices and how gold can fit into your overall investment strategy.

Whether you’re looking to diversify your portfolio or safeguard your wealth, our experts are here to assist you every step of the way. Visit our store or schedule an appointment for a personalized consultation.

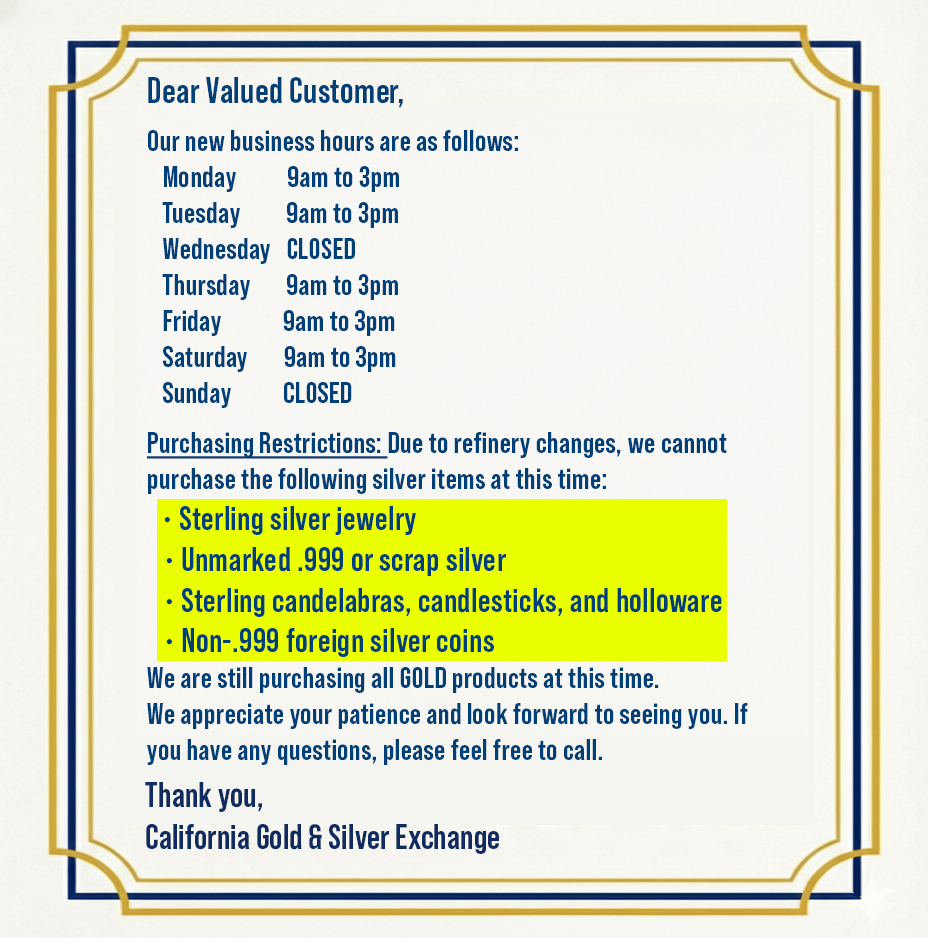

Call (909) 985-4653 for current pricing or to schedule an appointment for a personalized consultation. Or click here for our address and hours.