How Much Silver Should I Own?

As investors seek to diversify their portfolios and protect their wealth, silver has emerged as a compelling choice and the question — How much silver should I own? — has become a common one.

Unlike gold, silver’s unique blend of industrial demand and investment appeal offers distinct advantages. Still, there are multiple factors to consider when determining the appropriate amount of silver for your investment portfolio.

Most importantly, the amount of silver you own needs to align with your financial goals and risk tolerance.

Understanding Silver’s Role in an Investment Portfolio

Silver serves multiple functions in an investment portfolio, including the following:

-

-

- Hedge Against Inflation: Similar to gold, silver is considered a hedge against inflation because it maintains its value over time.

- Industrial Demand: Silver has numerous industrial applications, from electronics to solar panels. This drives demand and potentially increases its value.

- Safe Haven Asset: In times of economic uncertainty, silver, like gold, is viewed as a safe haven asset. Owning it is one way to protect and preserve your wealth.

- Diversification: Silver can diversify an investment portfolio, reducing overall risk and volatility.

-

Factors to Consider When Deciding How Much Silver to Own

Deciding how much silver to own is dependent on personal preferences and your unique situation. Here are some factors you need to consider when making that decision:

-

-

- Investment Goals. For example, are you looking for long-term wealth preservation, capital appreciation, or a hedge against economic instability? Your goals will shape your silver allocation.

- Risk Tolerance. Assess your risk tolerance. Silver prices can be more volatile than gold, so consider how comfortable you are with potential price fluctuations.

- Market Conditions. Evaluate current market conditions and economic indicators. In periods of industrial growth or economic uncertainty, a higher allocation to silver may be beneficial.

- Diversification Needs. Silver should complement your existing investments, providing balance and reducing risk.

-

Recommended Allocation Percentages

While there is no one-size-fits-all answer, the following guidelines can help determine your silver allocation:

- Conservative Investors: For those seeking stability and wealth preservation, allocating 5-10% of your portfolio to silver can provide a hedge against inflation and economic uncertainty.

- Balanced Investors: If you aim for a balance between growth and stability, consider allocating 10-20% of your portfolio to silver. This allocation offers diversification and potential for capital appreciation.

- Aggressive Investors: For investors focused on high growth and willing to accept more risk, a 20-30% allocation to silver may be appropriate. This leverages silver’s industrial demand and potential for significant price increases.

Types of Silver Investments

You’ll also need to consider the various forms of silver investments when deciding how much silver to own. For example …

- Physical Silver. When you own physical silver — such as coins or bars — you have tangible assets that hold intrinsic value. However, you’ll need to consider storage and security costs.

- Silver ETFs and Mutual Funds. Investing in silver via Exchange Traded Funds (ETFs) and mutual funds provides exposure to silver prices without the need for physical storage. This option gives you liquidity and convenience.

- Silver Mining Stocks. There’s a potential for higher returns when you own stocks in silver mining companies. However, this comes with additional risks related to the mining industry.

How to Determine the Right Amount of Silver for You

Finally, here are some tips to help you determine what amount of silver is right for you:

Financial Goals: Align your silver investment with your long-term financial objectives. Are you looking to hedge against inflation, capitalize on industrial demand, or diversify your portfolio?

Risk Tolerance: Understand your comfort level with price volatility. Silver can experience significant price swings, so ensure you are prepared for potential fluctuations.

Investment Horizon: Consider your investment timeline. For short-term needs or goals, a smaller allocation may be appropriate. For long-term wealth preservation and growth, a larger allocation can be beneficial.

Current Portfolio Composition: Evaluate how silver fits into your overall investment strategy. Ensure it complements your existing assets and contributes to a balanced, diversified portfolio.

By carefully considering all of these factors, you can make an informed decision and answer that question — How much silver should I own? — in a way that aligns with your overall investment strategy.

At California Gold & Silver Exchange, we specialize in helping you make sound investment choices. Whether you’re looking to buy silver coins, bars, or other forms of silver investments, our experts are here to give you the guidance you need.

Contact us today to learn more about how silver can contribute to your financial future as part of a diversified and secure portfolio.

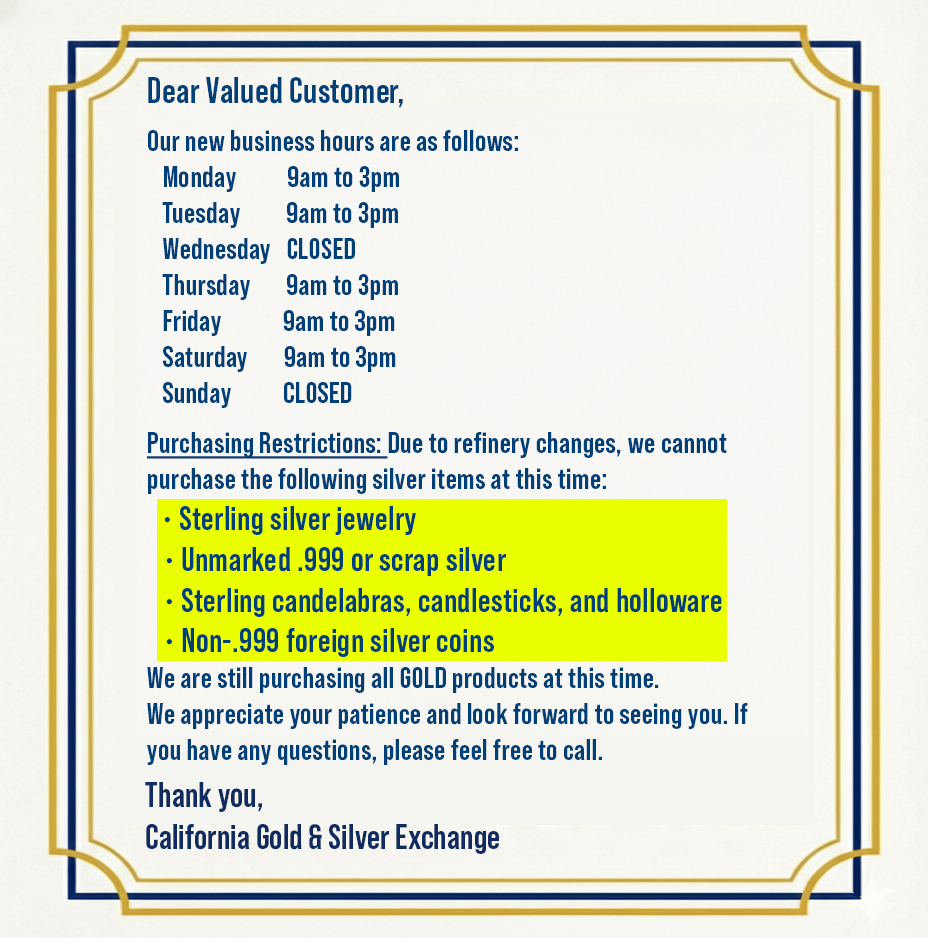

Call (909) 985-4653 for current pricing or to schedule an appointment for a personalized consultation. Or click here for our address and hours.