How Much Gold Should I Own?

Gold has been a symbol of wealth and stability for centuries. The question, “how much gold should I own?” is essential for investors looking to navigate the world of gold investing.

Historically, gold has been prized for both its intrinsic value and its role as a hedge against economic uncertainty. For smart investors looking to diversify their portfolios and protect their assets, gold remains a popular choice today.

But just how much gold should you own as an investment?

The answer is dependent on multiple factors, including your specific financial circumstances and personal preferences. Here’s some information to help you make an informed decision …

Owning Gold as an Investment

Gold serves several key functions in an investment portfolio, including the following:

- Hedge Against Inflation: Gold tends to maintain its value over time, making it an effective hedge against inflation and currency devaluation.

- Safe Haven Asset: During periods of economic or geopolitical uncertainty, gold often increases in value as investors seek stability.

- Diversification: Gold has a low correlation with other asset classes, such as stocks and bonds, which helps reduce overall portfolio risk.

Factors to Consider When Deciding How Much Gold to Own

Here are some of the factors to consider when determining your gold investment strategy:

- Your Investment Goals. Consider your financial objectives. Are you looking for long-term wealth preservation, protection against market volatility, or growth potential? Your goals will influence how much gold you should own.

- Your Risk Tolerance. Assess your risk tolerance. If you are risk-averse and seek stability, a higher allocation to gold may be appropriate. Conversely, if you are comfortable with higher risk, you may allocate a smaller percentage to gold and more to other asset classes.

- Market Conditions. Evaluate current market conditions and economic indicators. During times of economic uncertainty or high inflation, a larger allocation to gold may be beneficial.

- Diversification Needs. Determine how gold fits into your overall investment strategy. Gold should complement your existing investments, providing diversification and reducing risk.

General Guidelines for Recommended Allocation Percentages

Financial experts typically recommend that gold constitute a certain percentage of your investment portfolio. While there is no one-size-fits-all answer, the following guidelines can help:

- Conservative Investors: For those seeking stability and preservation of wealth, allocating 10-20% of your portfolio to gold can provide a solid hedge against economic uncertainties.

- Balanced Investors: If you seek a balance between growth and stability, consider allocating 5-10% of your portfolio to gold. This allocation provides diversification while allowing for growth potential from other investments.

- Aggressive Investors: For investors focused on high growth and willing to take on more risk, a smaller allocation of 2-5% to gold may be sufficient. This ensures some level of protection without significantly impacting growth opportunities.

Types of Gold Investments

When deciding how much gold to own, you’ll also need to consider the various forms of gold investments:

- Physical Gold: Owning physical gold — such as coins or bars — gives you tangible assets with intrinsic value independent of stocks and bonds.

- Gold ETFs and Mutual Funds: These investment vehicles provide exposure to gold prices without the need for physical storage, offering liquidity and convenience.

- Gold Mining Stocks: Investing in gold mining companies can offer leveraged exposure to gold prices, with the potential for higher returns. However, this comes with additional risks related to the mining industry.

At California Gold & Silver Exchange, we understand the importance of making sound investment choices. Whether you’re looking to buy gold coins, bars, or other forms of gold investments, our experts are here to help you navigate the process.

Contact us today to learn more about how gold can play a vital role in your financial future.

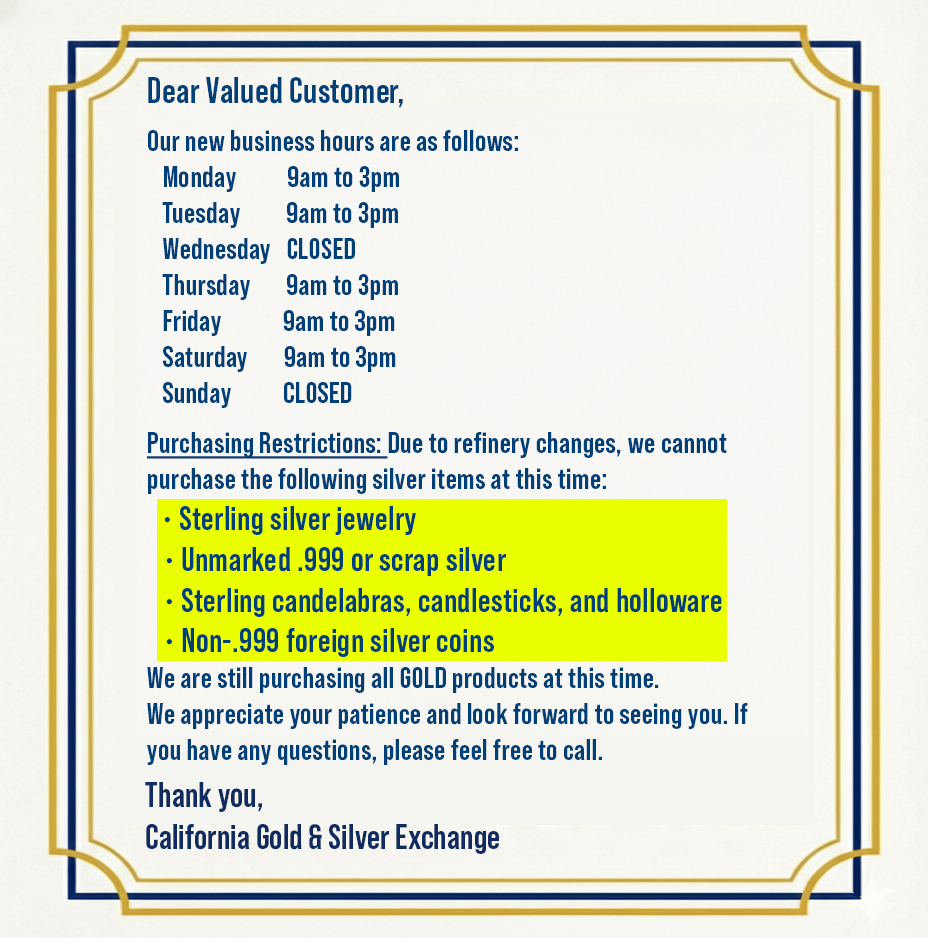

Call (909) 985-4653 for current pricing or to schedule an appointment for a personalized consultation. Or click here for our address and hours.